Colocation is just a collection of buildings, right? It's a bunch of square feet, measured out for network storage. A series of wires and cages—not much of a story there.

If you talk to TeleGeography's Senior Analyst Jon Hjembo for only a few minutes, you'll learn how wrong that is.

A few weeks back Jon and I got to talking about data centers as points of interconnection; these buildings are actually the key intersections in the modern information highway. (When I heard this take, I knew he had to be our next Spotlight interview.)

As you'll see, we recently caught up on TeleGeography's colocation research, key developments in the market, and the mergers and acquisitions making headlines.

You can read our conversation below or listen in here.

Jayne Miller: I appreciate people taking the time to talk about their expertise here at TeleGeography and we haven’t done a colo interview yet. It seems long overdue, Jon!

Jon Hjembo: This is great, I’m glad we’re able to do it.

JM: To get started it made sense to us to talk a little bit about what’s unique about the colocation research you’re doing here at TeleGeography.

JH: There’s really no dearth of colocation research out there in the market. More so than a lot of the other subject areas that we deal with. There are a lot of options out there and I think what makes us unique is that we tie this into our network research.

A lot of times people look at the colocation sector as a real estate play. There’s so much more to it than that.

A lot of times people look at the colocation sector as a real estate play. There’s so much more to it than that. If you want to get the big picture of what colocation is really about you have to look at it as a core node within networks. These are physical buildings where networks go to interconnect.

The perspective we bring to this market is that we paint this bigger picture that I think is really critical to show its place within the network environment. In doing that, we see a lot of really interesting parallels between what’s going on with network development—network trends—and colocation trends. So that’s particularly exciting.

One other aspect I should point out, too: while there are a lot of resources that will attract site locations on varying levels, being an analyst-vetted product, we have really up-to-date, relevant information, which is extremely critical. And I think very different than if you’re using a crowd-sourced model.

Lastly, as far as the overall research focus, our pricing is, I think, particularly unique. We’ve lumped pricing research in with the site research. Pricing is just one of these Holy Grail components that I think people have wanted for some time and we had considered doing for some time before taking the plunge. It was one of those things where you approach operators—they sort of hem and haw talking about how releasing such confidential information—to talk about how difficult it is to compare one service with one company to another.

And so we worked with some key operators to make sure that we did an apples to apples comparison across the board when we were looking at pricing research. And also to make sure, as with all of our pricing research, that we were completely anonymizing this so people were comfortable getting on board. And we’ve ended up having terrific contributions from the community. That’s been a tremendous addition to our colocation research.

JM: One thing I’ve heard you talk a lot about, and I’m going to prompt you to talk a little more about it now, is interconnection. I’ve been interested in your thoughts on that. If we look at the global network map today—we talked about that a little bit in one of our other Spotlights—I’d be curious to know where the big hubs are and what locations are emerging as big hubs of interconnection.

JH: Traditionally the major hubs are pretty predictable because we’re talking about locations that are major centers of commerce and population and communications. These hubs are also where networks go to converge, and then, by the same token, that’s where colocation develops. So if you look at our Global Internet Geography report and line that up with what you see in our Colocation Database, you’d see a lot of parallels in terms of major markets that we’re highlighting.

So in Europe, that’s the big four FLAP markets: Frankfurt, London, Amsterdam, and Paris. And then you have a couple of very predictable markets in Asia. Specifically, Singapore, Hong Kong, and Tokyo.

In the U.S. you’ve probably heard people talk about the NFL markets as being the major networking hubs, and there’s definitely some truth to that. Maybe Green Bay aside. But the biggest markets in the U.S. would certainly be the major markets you expect on the Eastern seaboard. New York and DC (which is really the Ashburn market), Chicago in the Midwest. Places like San Francisco and LA on the West Coast. But there’s a lot of depth in the U.S. market. There are a lot of really critical regional markets, as well.

I would also highlight Johannesburg in Africa. With all the cable development that’s happened there and with all the push to move toward the network edge, Johannesburg has definitely risen as a major hub there.

As far as secondary markets, the core markets tend to maintain a lot of momentum. Once you’ve established yourself as the place to be, the place where networks need to go to interconnect, that momentum continues to build. And we certainly see that. There is something of a counter to that, or at least sort of a distributing of that connectivity, as we see some secondary markets exploding. As content networks need to move closer to the network edge, we certainly see demand for alternate locations to the major regional hubs.

Once you’ve established yourself as the place to be, the place where networks need to go to interconnect, that momentum continues to build. And we certainly see that.

For example, in Europe we’ll see colo and network development taking place and really exploding in places like Stockholm and Marseille and transforming these peering points so that networks that otherwise might have gone on to Frankfurt or Paris from Eastern Europe to Stockholm. Or from Africa to Marseille, they’ll stop in those locations rather than going on further and having to backhaul further. They’ll peer somewhat more and in a location that’s somewhat more local to them. And be able to save on costs that way. We see some demand for that, certainly.

As far as the secondary markets that seem to really be booming now, ones that stand out in my mind are pretty much Stockholm, Milan, and Vienna in Europe. In North America, Phoenix has really been exploding. Toronto is growing. Las Vegas is growing, largely because of one operator. And in Asia Taipei and Melbourne have shown some really interesting growth. What’s interesting there is that the major hubs, Singapore and Hong Kong in particular, are still growing really rapidly. There’s a ton of demand there. We see faster growth in the core markets of Asia than in the core markets elsewhere.

JM: How have these market dynamics changed in the past few years?

JH: Well, one of the things we’ve been tracking is the influence of content on global network and colocation development. Kind of a shift in long-haul demand from PoP to PoP to datacenter to datacenter, for example. And a shift in terms of route prioritization. And in terms of peering locations that are in demand.

At TeleGeography we track seven major subsea cable routes. And on three of these routes—Trans-Atlantic, Trans-Pacific, and Intra-Asia—these content providers already account for more demand than the internet itself.

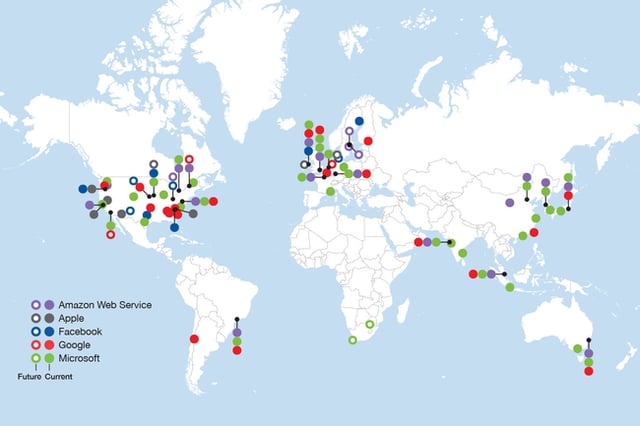

Content is driving everything and that’s one of the biggest trends that we’re watching right now. And when I say content I’m really talking about five companies in particular: Amazon, Apple, Google, Facebook, and Microsoft. These companies alone have such incredible demand for datacenter traffic that they’re driving projects and route prioritization for submarine cables. They are really driving demand for access to edge markets for colocation. And they’re driving demand in the core markets for both retail and wholesale colocation facilities. On the subsea side, at TeleGeography we track seven major subsea cable routes. And on three of these routes—Trans-Atlantic, Trans-Pacific, and Intra-Asia—these content providers already account for more demand than the internet itself. So that’s a major thing. And again to tie this in with what I said at the outset, it’s really interesting to see this bigger picture that content drives both the network and the colocation market demand. And we’re definitely tracking that across products here.

In relation to that, one of the interesting trends has been a boom in the wholesale sector with what we would call hyperscale cloud demand from these providers that I mentioned.

There’s actually a demand for this sweet spot colocation development between the major proprietary site scale and the retail scale—between the proprietary sites and the major metropolitan hubs where space may be more confined. There’s demand for wholesale colocation development in the 5-50 megawatt range for major content providers. So we see opportunities for growing wholesale providers like EdgeConneX, CyrusOne, and Keppel from Singapore, Digital Realty, to capitalize on that.

As a result, what’s interesting is that as these particular customers of colocation and network become the major drivers, it’s effecting M&A (mergers and acquisitions) as well, very significantly. When you see mergers happening it’s not just because you’re trying to expand your geographic footprint, but also, and sometime more so, because you’re trying to capture certain customers within markets [in which you may] already be present.

JM: Sure, and this is a good segue to ask you to drill down a little and talk about, on a company level, what changes you’ve been following lately.

JH: Yes, and that is a good segue because, and I was alluding to this, the concentration of consolidation we’re seeing is really extraordinary right now. If you look at companies like Equinix, Digital Realty, and NTT, they dwarf pretty much everyone else in the market. That’s one thing.

Equinix and NTT have been buying up providers around the globe. NTT’s done a lot of smaller purchases. Equinix has done fewer buys but bigger ones. And the two of these companies combined are more than two times the size of any other retail provider.

And then on the company level we’re also seeing the rise in niche players in the wholesale and the retail-side secondary markets. But to break down these two things. On the consolidation point, Equinix and NTT have been buying up providers around the globe. NTT’s done a lot of smaller purchases. Equinix has done fewer buys but bigger ones. And the two of these companies combined are more than two times the size of any other retail provider. The recent Equinix purchase of Verizon’s sites in the Americas added 3 million square feet to their portfolio.

And on the retail side, Digital Realty’s even more dominant in terms of its scale; it’s at least four and a half times of anyone else in the wholesale sector. Their recent purchase of DuPont Fabros added another 3.6 million square feet to what now totals more than 21 million square feet of gross space worldwide.

And again, I alluded to this point a little bit ago, but in both the Equinix purchase of the Verizon assets and Digital Realty’s purchase of DuPont, both of those mergers probably had more to do with capturing prime customer ecosystems than they had to do with reaching new markets.

On the secondary market side we’ve seen some consolidation with the recent merger of Peak 10 and ViaWest. They’ve just merged and they’ve now attained nearly nationwide coverage in the U.S. and into Canada. Not so much in the Northeast, but they have nodes in other key markets and in a number of smaller ones. So they’re capturing opportunities there.

And then on the wholesale side I had talked about these opportunities to build these wholesale facilities that address this kind of sweet spot need for content providers. We see companies like EdgeConneX, CyrusOne, Digital, and Switch capitalize on that.

Jon Hjembo

Senior Research Manager Jonathan Hjembo joined TeleGeography in 2009 and heads the company’s data center research, tracking capacity development and pricing trends in key global markets. He also specializes in research on international transport and internet infrastructure development, with a particular focus on Eastern Europe, and he maintains the dataset for TeleGeography’s website, internetexchangemap.com.