We've been tracking the market for long-haul networks and submarine cables since 1999. Our data documents the tectonic shift from submarine cable consortium owners to private builders and the eventual tech bubble burst.

But what does the global wholesale bandwidth market look like today?

We pulled three facts out of our Global Bandwidth Research Service to paint a picture.

1. Thirteen new systems worth a cumulative $2.4 billion were deployed in 2016.

Following several years of relatively sparse submarine cable development, 2016 ushered in a period of significant global investment in the sector.

A notable feature of the recent upswing in cable construction is the breadth and depth of its geographic scope. Nearly every global route grouping saw new subsea cables between 2015 and 2016. In the next two years investment is poised to continue on most routes with the launch of systems such as Seabras-1 (Latin America), New Cross Pacific (trans-Pacific), and others. Latin America leads the way with $1.5 billion of new cable investment in 2017 and 2018. (We estimate that $9.8 billion of new cables are entering service in 2016-2018.)

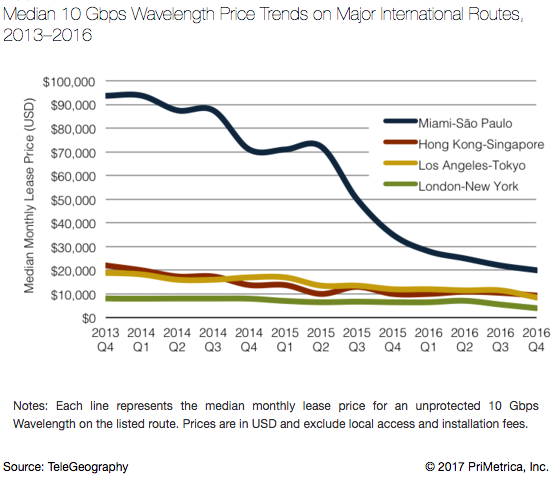

2. Median monthly lease prices across a selection of critical routes declined an average of 29 percent between 2015 to 2016.

Bandwidth prices continue to decline, driven by competition and an ever-expanding supply that lowers unit cost.

Median monthly lease prices across a selection of critical routes declined an average of 29 percent year-on-year between 2015 to 2016, and 27 percent compounded annually from 2013 to 2016.

Among these core 10 Gbps routes, Miami-São Paulo exhibited the steepest rate of price erosion at 40 percent compounded annually, dropping from 12 times the trans-Atlantic price in 2013 to five times the price in 2016. Prices on the London-New York and Los Angeles-Tokyo routes fell 21 and 24 percent compounded annually during the period.

3. Between 2012 and 2016 the amount of international capacity deployed by companies such as Google, Facebook, Microsoft, and Amazon has risen 14-fold.

The rapid expansion of major content providers’ networks has caused a major shift in the global wholesale market.

As Google, Microsoft, and Facebook invest in new inter-continental submarine cable systems and purchase increments of fiber pairs, they’re shifting demand from buying lit wavelengths in the wholesale market. With their demand strongly outpacing that of other customer segments, the share of international bandwidth market that is addressable by wholesale providers is declining.

But even the largest operators buy additional wholesale capacity to complement their primary investments in their own cable systems, and other operators move up through the ranks of network scale.

More companies may join the ranks of the largest content network owners, further decreasing the addressable wholesale proportion of the bandwidth market. But even the largest operators buy additional wholesale capacity to complement their primary investments in their own cable systems, and other operators move up through the ranks of network scale.

At the same time, the largess of content networks fuel new generations of submarine cables that lower the overall cost per bit across many routes, ultimately helping wholesale operators accommodate plunging bandwidth prices.

Alan Mauldin

Alan Mauldin is a Research Director at TeleGeography. He manages the company’s infrastructure research group, focusing primarily on submarine cables, terrestrial networks, international Internet infrastructure, and bandwidth demand modeling. He also advises clients with due diligence analysis, feasibility studies, and business plan development for projects around the world. Alan speaks frequently about the global network industry at a wide range of conferences, including PTC, Submarine Networks World, and SubOptic.