Global infrastructure company Telxius wants to sell its subsea cable business.

The announcement comes as Telxius majority shareholder Telefónica continues to restructure.

Telefónica has moved out of Central American markets en masse, created new technology and infrastructure units, and, in November 2019, announced an action plan outlining priorities for the changing company.

So what are Telxius’ subsea cable assets?

It would appear that their assets are heavily focused on Latin America, with a trans-Atlantic cable to boot. Major investments include some systems that are wholly-owned by the company like SAm-1 and BRUSA, while others—like MAREA, the Pacific Caribbean Cable System, and the planned Pacific Cable—are partially owned.

As investors assess the value of these assets, here are a few key issues to consider.

Addressable Demand

Demand for international bandwidth continues to grow. This holds true for the trans-Atlantic and U.S.-Latin America routes on which Telxius’ subsea assets are located.

Between 2015 and 2019, bandwidth demand on the trans-Atlantic route grew at a compound annual rate of 63%, while demand on the U.S.-Latin America route experienced a compound annual growth rate of 31%.

But just because the overall market is increasing at this rate does not mean the wholesale market is doing the same thing. Major content providers and many of the largest internet backbone providers invest directly in cables, which curtails their need to source capacity in the wholesale market.

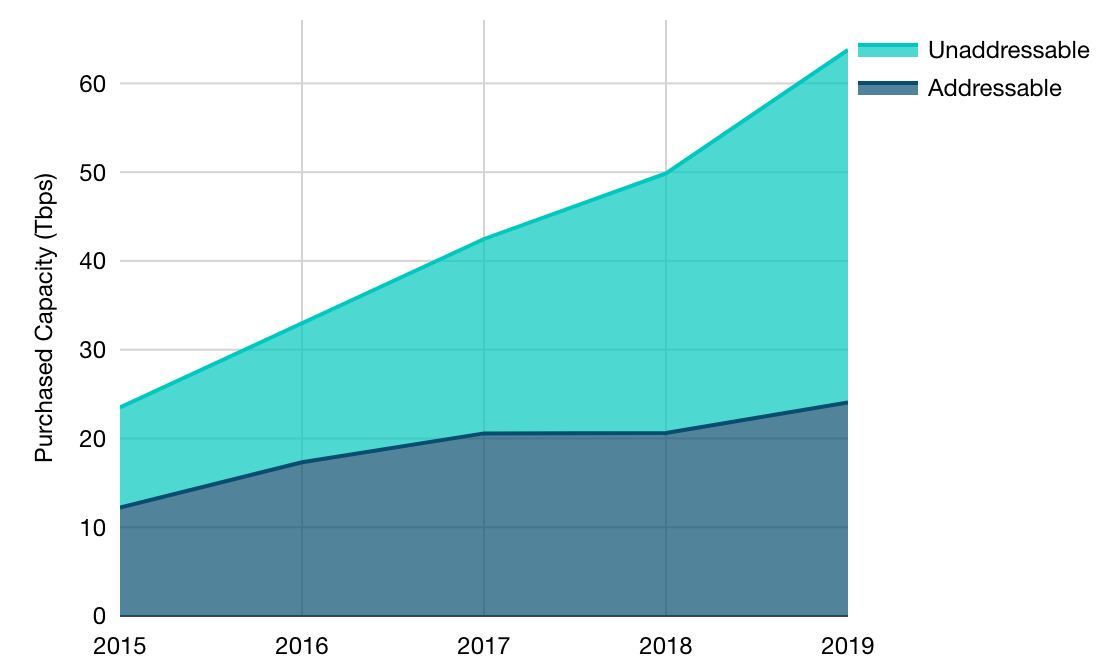

The share of addressable capacity—the amount of supply coming online that is available for purchase—has been decreasing across major submarine cable routes. In 2019, only 16% of the trans-Atlantic capacity was addressable, compared to 53% in 2015. Similarly, addressable capacity on the U.S.-Latin America route was 38% in 2019, down from 52% in 2015.

There’s Less to Address

Addressable U.S.-Latin America Capacity

Price Erosion

Investors frequently ask why capacity prices continue to fall when demand for bandwidth remains robust. This is certainly confusing. Anyone familiar with basic economic theory knows that as demand increases, prices also generally increase.

Submarine cables are unusual because they cost a lot to deploy but offer enormous economies of scale once capacity ramps up. As demand rises, a cable operator sells more capacity on its cable, reducing the cable's underlying unit costs. As unit costs decline, so do unit prices.

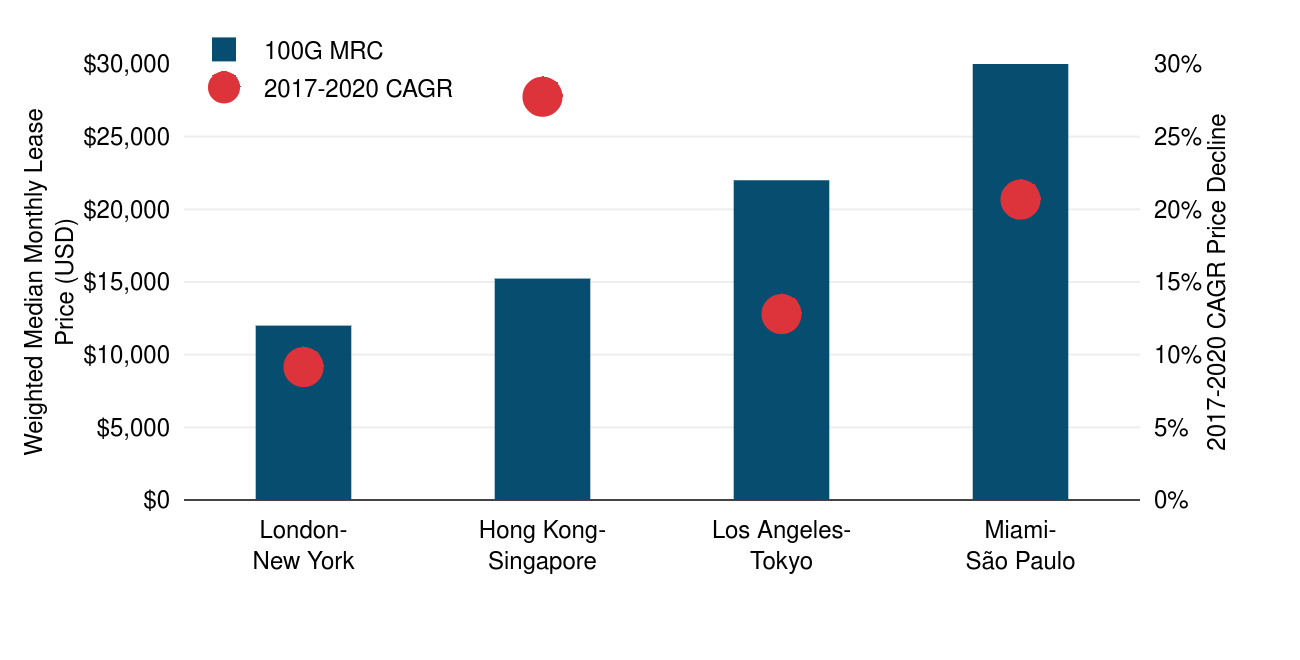

One of the few certainties in international bandwidth sales is that prices will fall. But falling prices do not happen uniformly across markets. We see below that more mature routes like London-New York tend to have lower price declines (9% from Q3 2017 to Q3 2020) than less mature ones like Miami-São Paulo (21%). But routes like Hong Kong-Singapore (28%) show that the fastest price erosion isn’t necessarily always on more expensive routes.

Death, Taxes, and Price Erosion

Weighted Median 100 Gbps Monthly Lease Prices on Select International Routes | Q3 2017-Q3 2020

Increasing Competition

New cable construction has surged in recent years—particularly on the trans-Atlantic. This route has welcomed four new systems since 2015, including Telxius’ MAREA. Three additional cables will come online by 2022.

The most recently announced cables, Amitie and Grace Hopper, will feature 16 fiber pairs compared to MAREA’s 8. Thus, the MAREA cable faces a lot of potential competition from new systems that will offer higher potential capacities.

Given the pace of demand growth on the trans-Atlantic route, even more cable construction is expected.

Aging Cables

Some of Telxius’ cables are rather old by cable standards. SAm-1 will reach its 20th birthday next year.

While cables are engineered to last for a minimum of 25 years, there’s nothing magical about that age. Cables can certainly provide service beyond 25 years in most cases, but the issue is really their economic lifespan. At some point, a cable may cost more to keep in service than it brings in revenue, which means retirement is likely on the horizon. This could happen even before capacity is exhausted on the system.

These are some of the key points to consider for any investors eyeing Telxius’ cable collection.

Of course, other factors come into play when deciding upon such a large purchase. For deeper analysis your best bet is to consult our extensive data collection or have us collaborate with you on a custom assessment of your options.

Anahí Rebatta

Anahí is a Senior Analyst at TeleGeography. As part of the infrastructure team, she heads the Global Internet Geography research service. Her regional focus is on Latin America and the Caribbean.

Peter Wood

Peter Wood is a Senior Research Analyst at TeleGeography. His work is focused on network services and pricing with a regional focus on Latin America and the Caribbean.