I call this one the price parity myth—the notion that one day bandwidth prices will be the same on all routes.

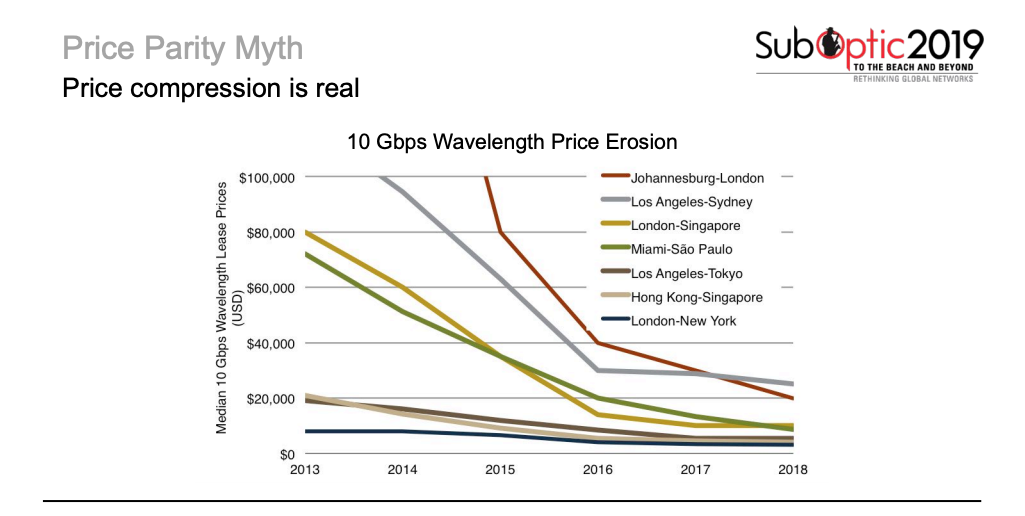

Why is this a myth? Well, if you look at TeleGeography pricing data—take monthly lease prices for 10 Gbps wavelengths on a wide array of routes—there’s been a compression of prices for some time. If we were to plot out prices for the future, perhaps we’d see continued compression and these routes would all reach the same point?

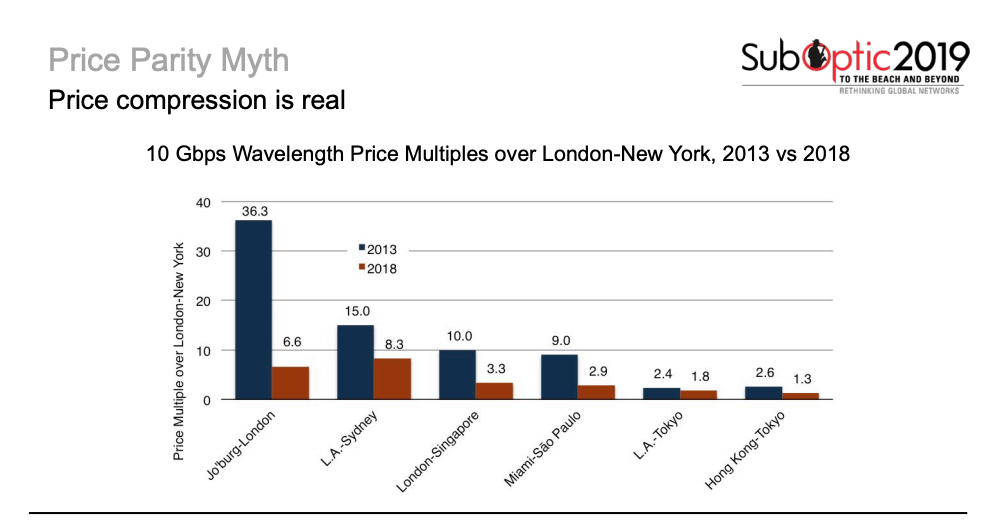

I looked more at the way prices have compressed compared to a single route: London to New York.

Looking at 10 Gbps prices as a multiple over the London to New York route from 2013-2018, you can see Johannesburg-London used to be 36 times a London-New York route for a 10 Gbps wave. Now it’s just 6.6 times as much. It’s a big change. And it’s become much closer to some of the other routes.

On the other end of the spectrum, we can look at prices on the Hong Kong-Tokyo route, where the prices have come from being 2.6 times higher to just 1.3 times higher. It would seem that we’re getting close to some routes reaching parity with the trans-Atlantic route.

Why Are Prices Different on Different Routes?

Next, I decided to look closer at why prices vary to begin with. Honestly, there are a lot of reasons. But there are four big ones worth talking about.

The first is length. Longer routes require more fiber and repeaters. They also use more power and have higher maintenance costs.

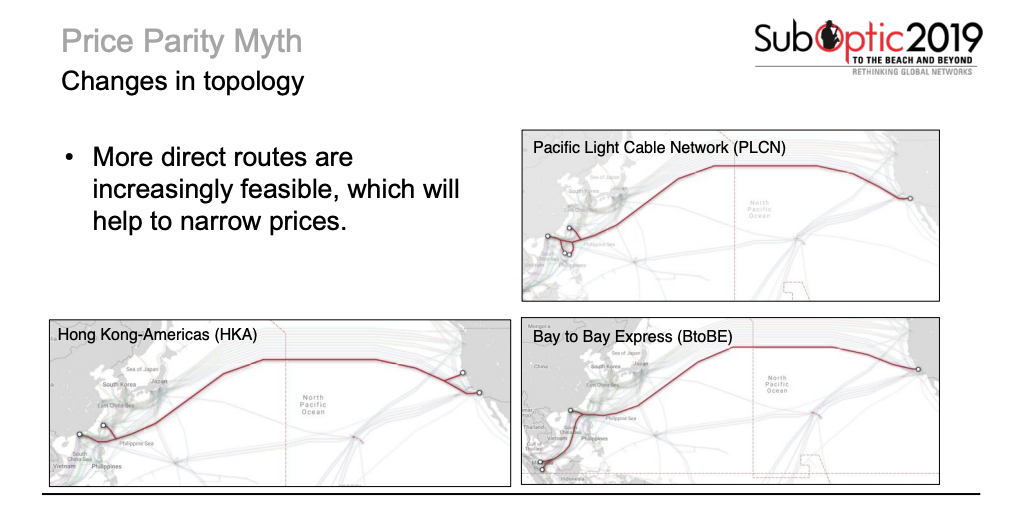

The second reason is topology. You can’t link every point on the globe via an express fiber route; that’s not possible. Some routes require multiple segments, there are different landing points, and the availability of express fiber pairs comes into play. These differences ultimately lead to different prices.

Next up is demand. Even if we were to have the same topology on all cables, the demand would need to be the same. Higher capacity cables have lower unit costs; this certainly has a bearing on why prices tend to be different around the world.

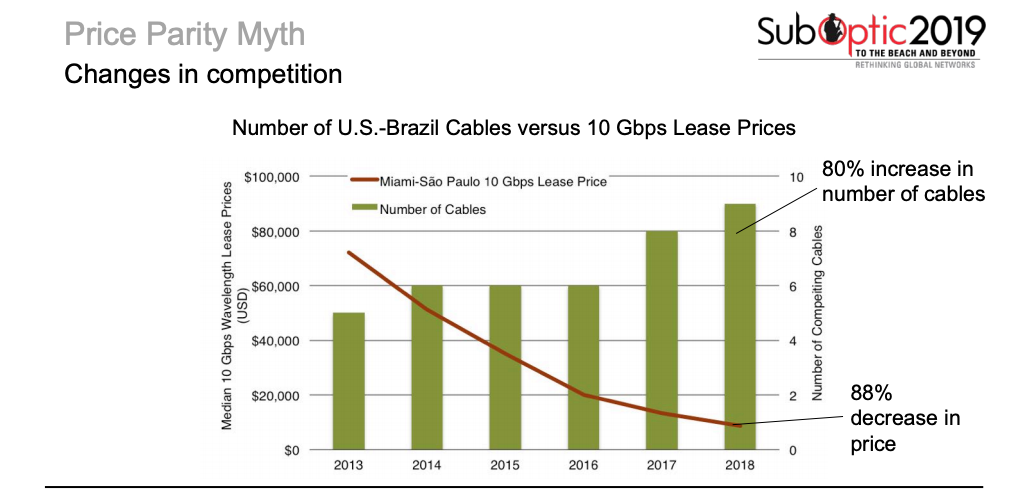

Finally, there is obviously competitive differences. More cables on a route drive prices down, plain and simple.

How Do We Reach Price Parity?

The next step is to think about what is changing with length, topology, demand, and competition that could theoretically allow us to reach price parity.

Cable lengths are technically changing, but not particularly quickly. I acknowledge the movement of tectonic plates, but for the sake of this argument, our cable lengths are pretty fixed.

We are seeing some changes in topology. More direct routes are possible.

Looking at maps of new trans-Pacific cables, new direct links between the U.S. and Hong Kong or Singapore could allow the prices on those routes to become more similar to a Japan-U.S. route. In the past these locations had to go through Japan on their way to the U.S. This element is potentially moving in favor of parity.

Next, I looked at the capacity of cable. Demand is indeed increasing, lowering unit costs.

However, we’d need demand per cable to be similar in order for costs to align. And lit capacity still varies a lot cable to cable. This doesn’t seem like it will allow us to get closer to price parity.

And last we have competition. I used the U.S.-Brazil route as a test case, as this is a route we’ve seen a lot of changes on over the last few years. We’ve seen an 80% increase in the number of cables between 2013 and 2018 and a corresponding 88% decrease in 10 Gbps lease prices. That signals a clear impact. More cables on a route, more price erosion.

The Verdict

Let’s review. Is parity possible?

Length isn’t going to help us get there. Topology, while changing, will never link every city pair directly.

It’s deeply unlikely that we’ll ever see every cable in every part of the world with a similar demand.

Finally, we could have more cables boost competition around the world.

Overall, prices are likely to continue narrowing, but global price parity is not possible. These four core factors will not change enough to achieve it.

I think we’ll call this myth busted.

Alan Mauldin

Alan Mauldin is a Research Director at TeleGeography. He manages the company’s infrastructure research group, focusing primarily on submarine cables, terrestrial networks, international Internet infrastructure, and bandwidth demand modeling. He also advises clients with due diligence analysis, feasibility studies, and business plan development for projects around the world. Alan speaks frequently about the global network industry at a wide range of conferences, including PTC, Submarine Networks World, and SubOptic.