At this year’s Pacific Telecommunications Council conference, I spent some time talking through TeleGeography’s latest pricing research findings and tackling the most common questions we've received over the past year.

In case you missed it, here's a recap of my Taylor Swift-themed presentation: Global Pricing Trends in a New Era.

Last year, we found ourselves in uncharted territory. Delays in new supply had dramatically slowed price erosion around the world, leaving us to wonder if prices were actually increasing.

Are we out of the woods yet? Not entirely.

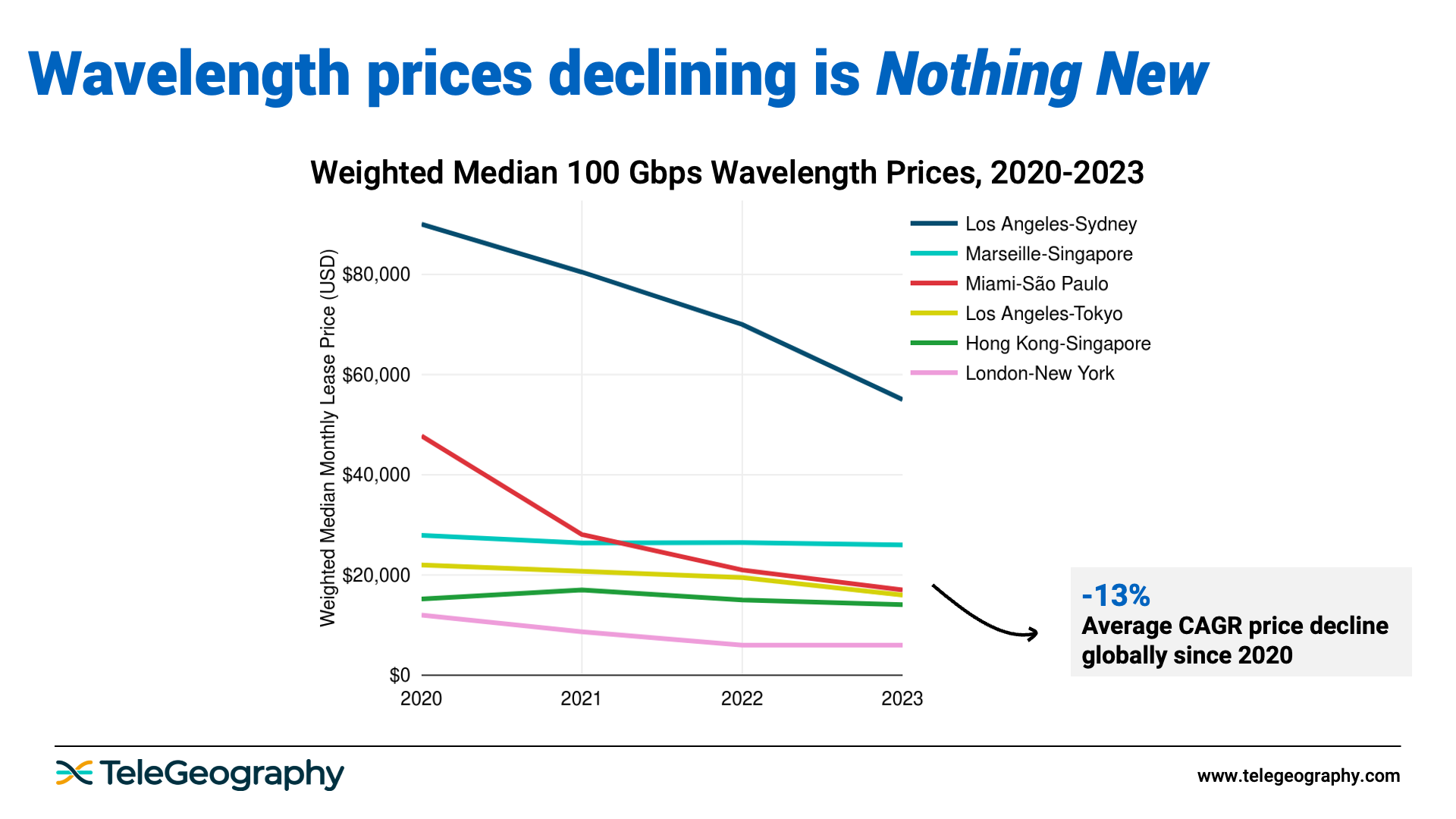

Over the past three years, 100 Gbps prices across six key global routes continued to decrease about 13% on average.

Of course, we saw a wide range in price erosion trends—prices decreased just 2% on Marseille-Singapore vs. 29% on Miami-São Paulo—but that's not the big story here.

Despite these declines, price erosion is happening at a much slower pace than we're used to seeing in the market.

In the figure below, we've mapped out 100 Gbps wavelength CAGR price declines from 2017-2020 (turquoise) and 2020-2023 (dark blue).

As you can see, price declines have dramatically slowed across all six of these routes. From 2017-2020, we saw a 30% average decline. That number reduced to just 13% from 2020-2023.

There are a few factors at play here.

These are very competitive submarine cable routes, and 100 Gbps prices are already low. Plus, we're still seeing delays in new network supply on a lot of these routes.

Yes, card shortages and supply chain disruptions have resolved themselves, but geopolitical issues—such as in the Red Sea and South China Sea—are delaying network projects.

Fewer cables with inventory at one time has led to less competitive price pressure. However, on routes with recent upgrades, new supply, and pre-sales on new systems, price erosion is returning to higher levels.

On routes with recent upgrades, new supply, and pre-sales on new systems, price erosion is returning to higher levels.

In the meantime, uncertainty on the timeline of future supply on some routes has changed customer purchasing patterns.

Supply is being snatched up before it becomes available or bought in bulk, so even if upgrades are happening, that capacity may already be spoken for. Customers are taking capacity at the price that is offered, and that's helping to maintain price points.

What about 400 Gbps? How is demand for this service shaping up, and what are pricing models looking like worldwide?

How have these transport trends impacted the transit market?

Last year, our data suggested that the supply scarcity and inflationary pressure on network equipment costs had also muted IP transit price erosion. That's no longer the case.

Brianna Boudreau

Senior Research Manager Brianna Boudreau joined TeleGeography in 2008. She specializes in pricing and market analysis for wholesale and enterprise network services with a regional focus on Asia and Oceania. While at TeleGeography, Brianna has helped develop and launch several new lines of research, including our Cloud and WAN Research Service.