As cloud adoption becomes increasingly necessary for multinational enterprises, networks are becoming more complex. They now need to connect not just corporate offices to each other, but to various cloud providers at optimal locations.

The introduction of X-as-a-service products and the need for multi-cloud environments have pushed WAN managers to make changes to their current ecosystems and adopt new network technologies.

Our WAN Manager Survey—which is available to all of our Cloud and WAN Research Service subscribers— considers how network professionals are integrating the cloud and Networking-as-a-Service (NaaS) into their enterprise networks.

We analyze survey results on data center locations, Infrastructure-as-a-service (IaaS) adoption, IaaS partner choices, how companies are connecting to their cloud service providers (CSPs), and NaaS adoption. In previous surveys, we covered cloud questions every other year. In our latest refresh, we decided to sprinkle in a few cloud questions to ensure we capture an accurate time series in this rapidly changing environment.

Curious about what we discovered? We thought you might be.

Data Centers

We asked respondents about their data center locations and changed our response options this year to better capture the possible options. While this makes a time series impossible to construct, we have hopefully better captured where enterprises are locating their data centers in this market.

- A strong majority–87%–of respondents still have some on-premises data centers.

- While most respondents do have on-premises data centers, nearly all of them have some kind of off-premises DCs. In 2023, 64% of respondents housed data centers in a public cloud and 64% had private cloud data centers.

- About one-third of respondents have off-premises bare metal service.

In 2023, we decided to take a closer look at the phenomenon of "cloud/data center repatriation" or the decision to move applications, data, or other assets back on-premises after having previously migrated them to the cloud. This trend has become a bigger topic of discussion in the industry as many players have seen enterprises realize that the cost or performance of some cloud assets wasn’t living up to their expectations.

We asked respondents if they had moved any cloud assets back to corporate premises or otherwise away from CSPs over the past two years. Only 15% of respondents indicated that they have.

- Of that 15% of respondents, half indicated that their primary reason for doing so was that the cost of cloud services was too high. The other 50% chose to engage in cloud repatriation because cloud performance was inadequate.

- None of the respondents indicated that they decided to repatriate data back to private facilities because cloud security was too difficult.

Networking-as-a-Service

We first asked about enterprises’ familiarity with and approach to the emerging NaaS last year. (But we've been talking about it with our podcast guests for a while now; lots of good chatter over there if you're up for a detour.)

NaaS allows enterprises to consume network infrastructure through a subscription model like cloud services to meet business needs and optimize network performance on an on-demand basis.

NaaS allows enterprises to consume network infrastructure through a subscription model like cloud services to meet business needs and optimize network performance on an on-demand basis.

The central idea of NaaS is that enterprises can quickly provision and consume network services as needed rather than through a long-term contractual agreement. Key to this are portals where enterprises can log on and allocate network connections down to even an hourly basis in some cases. Rather than weeks or months to spin up this service, it is generally available upon ordering.

This is often limited to the core network and data center traffic, as bandwidth-on-demand would rarely be available down to a local corporate site. Backbone networks are over-provisioned sufficiently to accommodate just-in-time networks, but this is rarely the case for last-mile connections.

So NaaS is mostly a service to connect resources like data centers, large call centers, disaster recovery sites, and other corporate compute centers located where fiber assets are widely available–not to spin up service to permanent branch offices or local corporate sites. However, where high-speed last mile solutions like FTTx and 5G service are available, there are potential use cases for NaaS at locations with intermittent events, seasonal sales, or even temporary sites.

We found that while NaaS products are available on the market, few enterprises have purchased them. Some enterprises were still in the research phase, but unlike last year, very few respondents were still unfamiliar with the service.

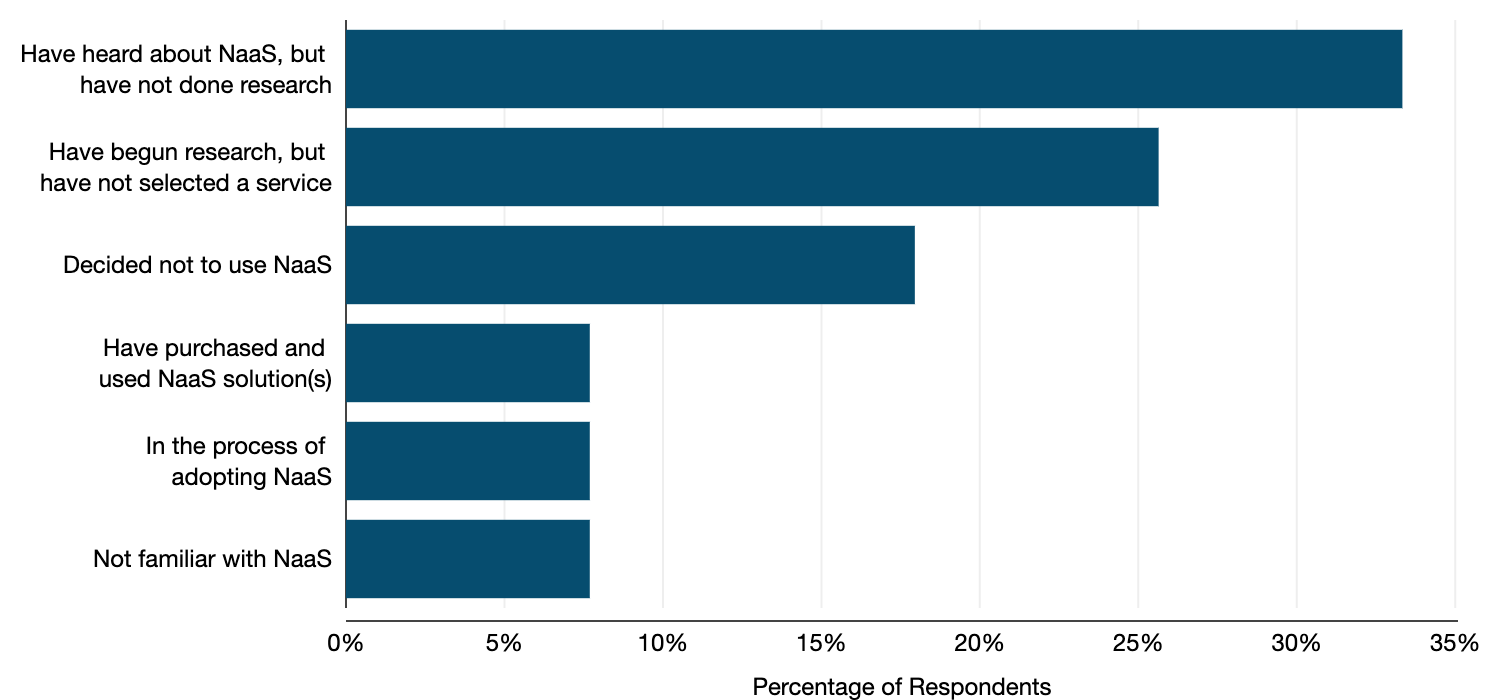

What best describes your use of NaaS? (2023)

- While only 8% of respondents were already using NaaS, another 8% were in the process of adopting it.

- About one quarter indicated that they are researching NaaS.

- A plurality, about one-third of respondents, had heard about NaaS but have not done any research. This is still an indication that carriers need to demonstrate the use cases to some enterprises to spur interest.

- Only 8% of respondents indicated that they are not familiar with NaaS.

NaaS adoption stage (2022-2023)

- The biggest change of note on our second year of asking about NaaS is that in 2022 more than one third of respondents had not yet heard of NaaS. That fell to only 8% this year, indicating that the product is gaining traction in the market.

- Only slightly more respondents had actually purchased NaaS this year, and about the same number were adopting it.

- A similar number had heard of NaaS but not looked into it, again an indication that carriers may need to work to sell the concept to busy WAN managers already mired in complicated network and security transformations.

Download the free executive summary for a closer look at our latest survey results. Or—if you prefer your data in deck form—download my related slide deck from the 2024 Enterprise Network & Security Summit over here.

Greg Bryan

Greg is Senior Manager, Enterprise Research at TeleGeography. He's spent the last decade and a half at TeleGeography developing many of our pricing products and reports about enterprise networks. He is a frequent speaker at conferences about corporate wide area networks and enterprise telecom services. He also hosts our podcast, TeleGeography Explains the Internet.