The COVID-19 pandemic fundamentally changed the way we work. And our next scenario illustrates the reality that many IT infrastructure managers are currently facing.

(If you're new here, check out the first post in this series first.)

A large portion of the workforce is now remote at least part of the week. When employees are in the office, they continue to utilize bandwidth-hungry applications like Zoom, Microsoft Teams, and Google Meet to stay connected.

As such, many enterprises are thinking of consolidating the number of sites they have—while increasing bandwidth in those that remain open—in an effort to save money.

Changes/Predictions Made by Our WAN Managers

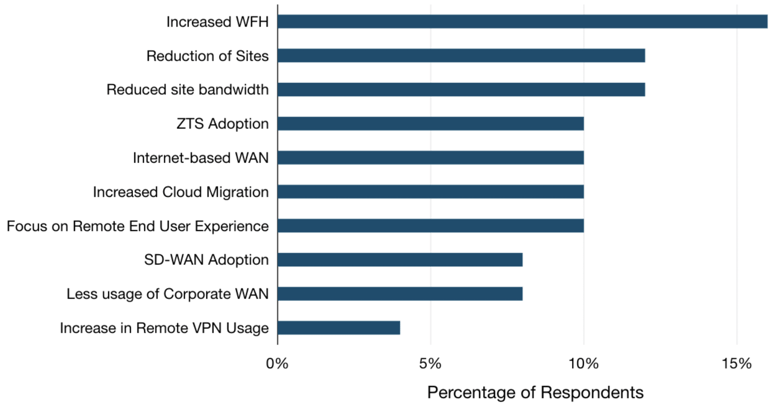

Many of these changes were anticipated by our WAN Manager Survey respondents when we asked how they saw the temporary shift to remote work rippling out into the future. Common responses are listed in the chart below.

What long-term changes do you expect as a result of the pandemic?

Source: TeleGeography

Source: TeleGeographyExcluding the folks who didn’t foresee any long-term changes, the most common viewpoint was that working remotely would likely remain a fixture in the professional world.

Sixteen percent of respondents indicated that an increased base level of remote working flexibility would likely be offered by their company, and in the industry at large, now that current conditions have proved it viable and even preferable to have employees working remotely part or full-time.

WAN managers also mentioned the following potential long-term changes to the WAN as a result of the pandemic shutdowns:

- Twelve percent of respondents predicted a reduction in the number or size of corporate sites. One respondent from an engineering firm said that on the long-term horizon, they saw office space reduction coming into focus “when we have our real estate renewals coming up.”

- Another 12% of respondents also mentioned a reduction in office bandwidth as a result of fewer employees working from corporate sites. Some respondents specified that they expected reductions in secondary or redundant lines if overall office attendance decreased long-term.

- One in ten expected the fallout of the extended quarantine and self-imposed isolation to accelerate trends we already see in the market, such as adopting zero trust security policies, migrating to the cloud, and incorporating Internet into the WAN. The pandemic and ensuing isolated work environments proved to some that the network needs to be flexible and secure enough to handle users connecting from anywhere, on a variety of devices.

- One-tenth of respondents also predicted an intensified focus on improving the remote end user experience.

- Eight percent of respondents expected an uptick in SD-WAN adoption as a potential long-term result.

To model this situation, our remote work scenario implemented the following changes:

- Close some sites entirely (especially any redundant metro sites). This hypothetical network includes 126 sites, down 24 from the original 150.

- Decrease all MPLS significantly (i.e., 50-75% reduction in bandwidth) and remove backup ports/lines. Only voice and video traffic will remain over MPLS at Tier 1 and Tier 2 sites.

- Add in DIA to all sites to match original size at remaining Tier 2 and Tier 3 sites.

- Increase data center port sizes to accommodate those accessing the network remotely.

- Add in managed SD-WAN to all sites.

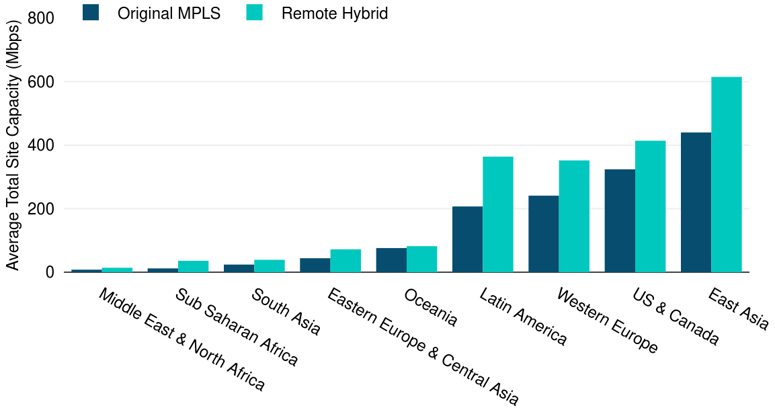

The resulting network has a global average capacity of 345 Mbps at each site, a 40% increase over our original MPLS WAN.

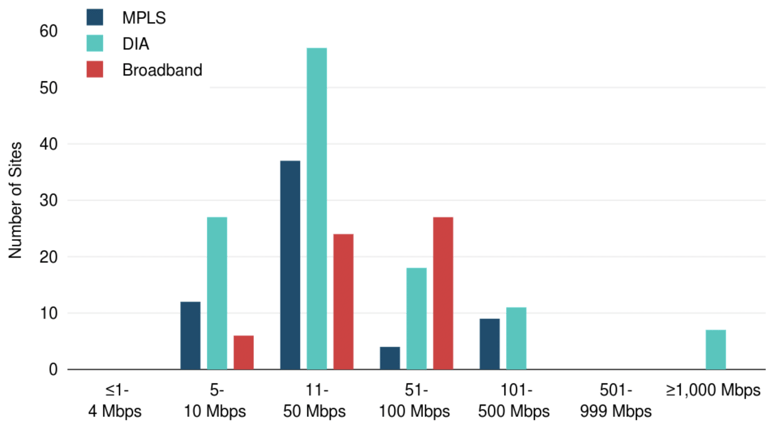

Once again, most of our DIA sites fell in the 11-50 Mbps range, while the largest amount of broadband sites were in the 51-100 Mbps range. While site capacity increased across all of our subregions, it is notable in this scenario that Latin America saw an increase almost on par with Western Europe.

Remote Hybrid WAN Site Count by Capacity Range

Remote Hybrid WAN Average Site Capacity by Subregion

Source: TeleGeography

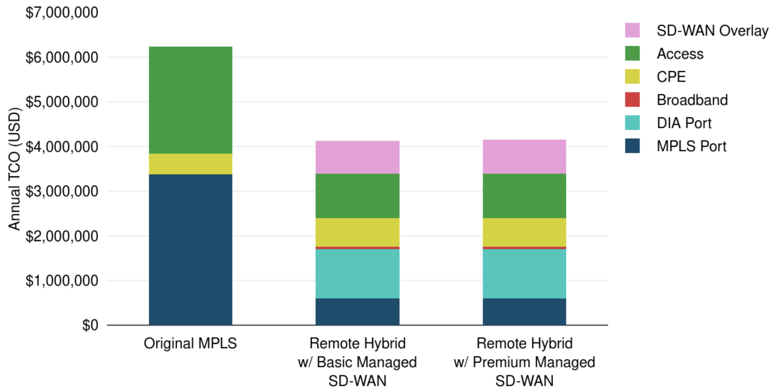

Source: TeleGeographyEven after increasing capacity at the remaining network sites, our remote hybrid networks offered substantial savings.

Even after increasing capacity at the remaining network sites, our remote hybrid networks offered substantial savings.

Both the remote hybrid with basic managed SD-WAN and premium managed SD-WAN were 34% less than our original MPLS network. Opting for a premium managed SD-WAN overlay in this scenario was an increase of just $20,095 per year.

Original MPLS and Remote Hybrid WAN with SD-WAN Annual TCO

Source: TeleGeography

Source: TeleGeographyWhile there may be some industries that have returned to the offices in full, others have found that many roles can be partial or full-time remote while remaining effective. And adapting the network to accommodate this flexibility has become top of mind for many.

As this scenario demonstrates, network savings can be achieved in a remote hybrid environment that reduces network footprints, but boosts the bandwidth at remaining sites to accommodate in-person and remote employees and their applications.

Up Next: Let’s Throw Bandwidth at the Problem

Good news!

This series is now an e-book.

Download your free copy to explore all five of our hypothetical scenarios in one place.

Mei Harrison

Mei Harrison was formerly a Junior Research Analyst at TeleGeography. Her research was focused on WAN.