French telco group Iliad has submitted a proposal to UK-based Vodafone Group regarding the potential merger of their respective operations in Italy.

If successful, the merger will have a big impact on the Italian mobile market, reducing it from five players to four, while also combining the fixed broadband operations of the two companies.

The deal is by no means guaranteed to go through, however. Even if Vodafone’s response is positive, regulatory authorities must then study its effects on competition.

More Details

The proposal values Vodafone Italy at €10.45 billion ($11.4 billion) and Iliad Italy at €4.45 billion.

Vodafone Group would obtain 50% ownership of the merged entity (dubbed NewCo) together with a €6.5 billion cash payment and a €2.0 billion shareholder loan. Iliad, meanwhile, would get 50% of NewCo together with a €500 million cash payment and a €2.0 billion shareholder loan.

As part of the proposed transaction, Iliad would have a call option on Vodafone Group’s equity stake in NewCo and would be able to acquire a block of 10% of the NewCo share capital every year at a price per share equal to the equity value at closing. In the event Iliad chooses to exercise the call options in full, this would generate an additional €1.95 billion in cash for Vodafone Group.

Based on Vodafone Italy’s estimated EBITDA after Lease (EBITDAaL) of €1.34 billion for FY 2024 (as per broker consensus), the proposed transaction implies an EBITDAaL multiple of 7.8x. This is higher than the 7.1x EBITDAaL multiple offered by Iliad in its €11.25 billion takeover offer for Vodafone Italy in February 2022, which was quickly rejected by Vodafone Group.

The merged business would be expected to generate revenues of around €5.8 billion and EBITDAaL of approximately €1.6 billion for the financial year ending March 31, 2024.

The merged business would be expected to generate revenues of around €5.8 billion and EBITDAaL of approximately €1.6 billion for the financial year ending March 31, 2024.

According to Iliad, the financing of the transaction is supported by leading international banks and the deal has the unanimous support of its board of directors plus its main shareholder, Xavier Niel.

Thomas Reynaud, Iliad Group CEO, commented: “The market context in Italy calls for the creation of the most innovative telecom challenger, with ability to compete and create value in a competitive environment. We believe that the profiles and complementary expertise of Iliad and Vodafone in Italy would allow us to build a strong operator with the ability and financial strength to invest for the long term.”

“NewCo would be fully committed to accelerating the country’s digital transformation and especially fiber adoption and 5G deployment, with more than €4 billion of investment planned over the next five years,” he added.

Vodafone Background

Vodafone has been present in Italy since September 1995, when it launched as the first competition in the mobile market for incumbent operator Telecom Italia (TIM).

The company—initially known as Omnitel—was founded by a number of shareholders, including Olivetti, Bell Atlantic International (now Verizon Communications), and Telia International (now Telia Company).

It rebranded as Omnitel Vodafone in January 2001 and then Vodafone Omnitel in May 2002 in a bid to capitalize on the reputation of the UK-based Vodafone Group, which had come on board as an investor two years earlier. In May 2003, the Omnitel moniker was dropped altogether, by which time Vodafone had been left as the 100% owner following the gradual departure of its partners.

Vodafone Italy launched 3G in 2004, 4G in October 2012, and 5G in June 2019.

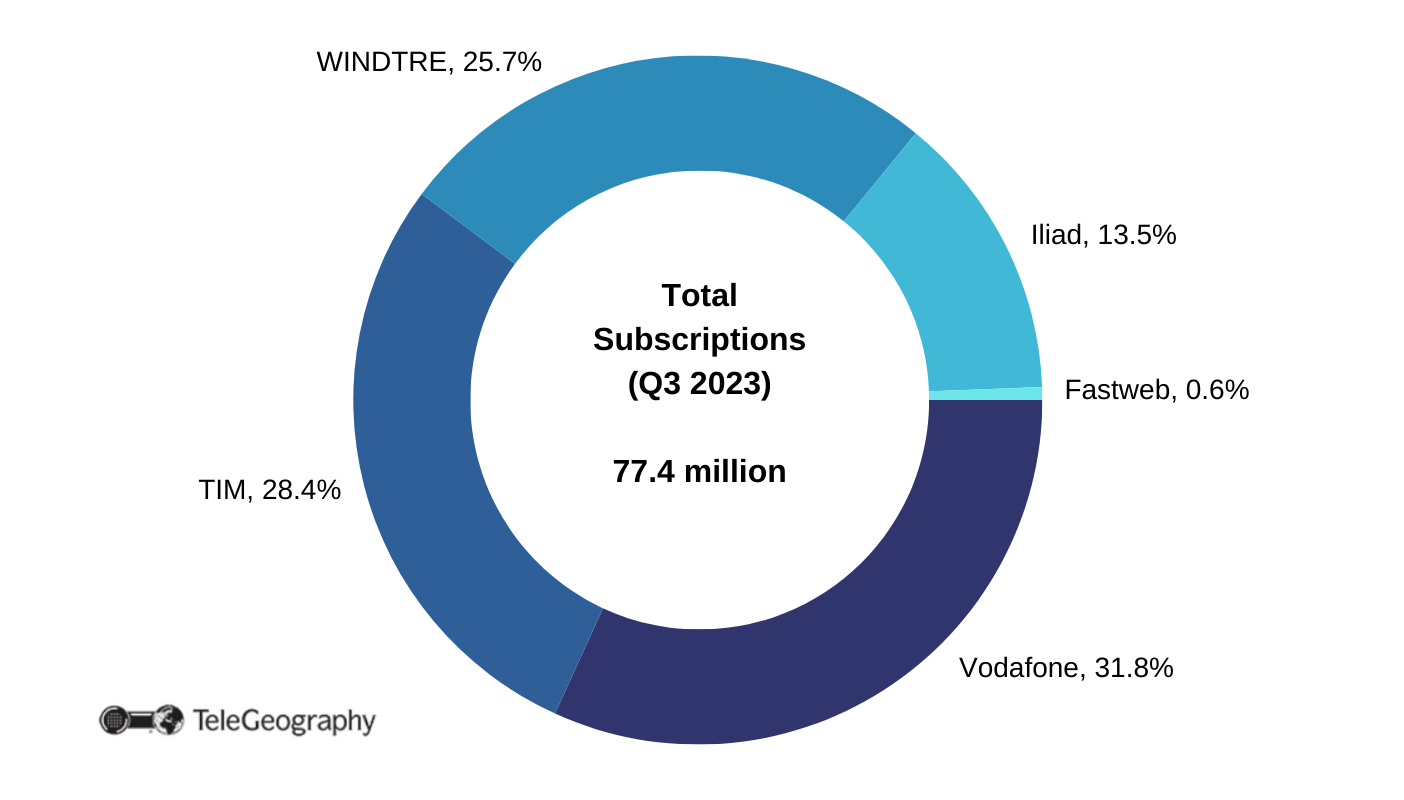

According to TeleGeography’s GlobalComms Database, at the end of September 2023, it had accumulated an estimated 24.6 million mobile subscriptions—including customers of its MVNO partners but excluding M2M connections—making it the country’s largest cellco with 32% of the market.

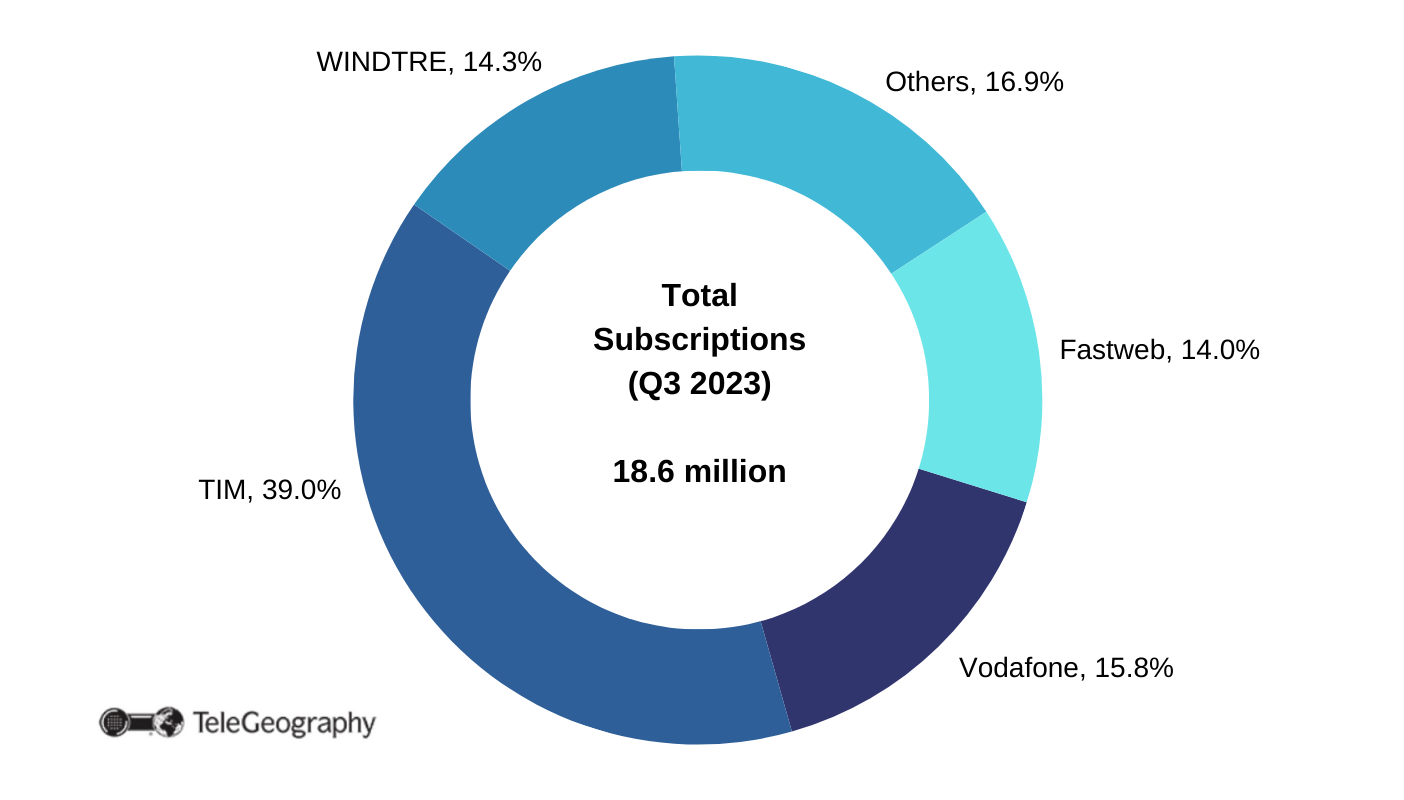

In the fixed broadband sector, Vodafone offers a range of access products based on VDSL and fiber-to-the-home technologies, using its own networks plus those of wholesale partners. It also uses its 4G and 5G networks to connect households outside of the fixed network footprint.

As of September 30, 2023, Vodafone had 2.95 million fixed broadband subscriptions.

Newer Challenger

Iliad Italy is a much younger company, established in 2016 to acquire spectrum and some network assets from mobile network operators (MNOs) 3 Italia and Wind Telecomunicazioni, which had agreed to a merger.

In order to appease regulators worried about the deal’s effects on competition, the pair created a “remedy package” to allow a new MNO to join the market.

Iliad eventually launched mobile services in May 2018, going on to win 5% of the overall market within twelve months and 10% by the first quarter of 2021. As of September 30, 2023, Iliad had 10.48 million mobile subscriptions and a 13.5% market share.

Italy Mobile Market, Q3 2023

It joined Italy’s fixed broadband sector in January 2022, having signed wholesale agreements with the likes of Open Fiber and TIM. It had 172,000 broadband customers by end-September 2023.

Italy Fixed Broadband Market, Q3 2023

Pete Bell

Pete Bell is a Senior Analyst for TeleGeography’s GlobalComms Database and also contributes to the daily CommsUpdate newsletter. He has a particular interest in wireless broadband and was responsible for TeleGeography’s 4G Research Service until it was integrated into GlobalComms.