Providers’ shift to predominantly 100 Gbps internet backbones continues to reduce the average cost of carrying traffic, enabling profitability at lower prices. As a result, price erosion remains the universal norm, reflecting the introduction of competition into new markets and the response of more expensive carriers to lower prices.

Trends in the IP transit market generally mirror regional trends of the transport market, which is driven by new infrastructure and technologies that enable greater scale and efficiency. Because IP transit relies on these high-capacity links, when transport prices decline, we typically see IP transit prices follow suit.

And while IP transit prices continue to decline worldwide, the larger story in the most established hubs has been the bottoming out of reported low prices, as a growing number of carriers position themselves at the lower end of the price range.

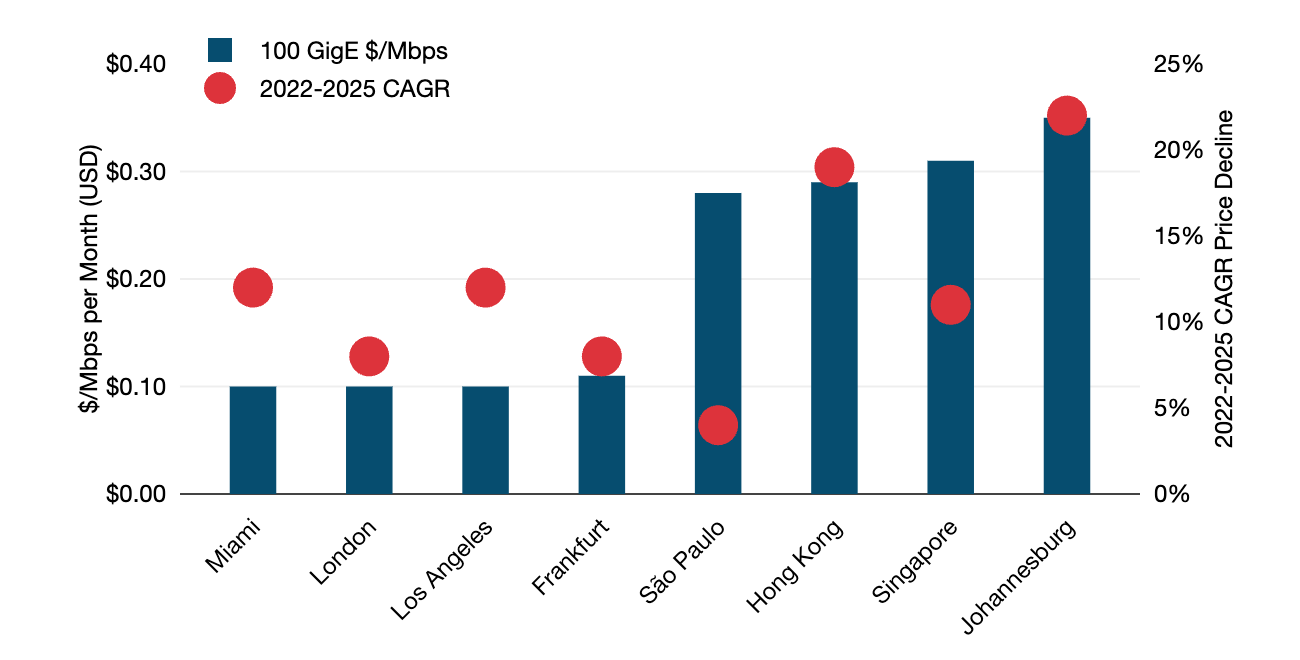

Across the cities included in the figure below, 100 GigE prices fell 12% compounded annually from Q2 2022 to Q2 2025.

Weighted Median 100 GigE IP Transit Port Prices & CAGR Price Decline in Key Global Cities

The activation of large-scale subsea cable systems drove the most significant price declines in historically expensive developing markets, such as Africa and South Asia. These high-capacity systems reduce unit costs, fostering intense competition. Increased local peering and content localization further improve network performance and reduce the subsea cost component of IP transit.

Established international network hubs such as Miami, London, and Singapore have long had an ample number of providers offering service, host a large amount of content, and already report some of the lowest prices globally. In these markets, the larger story has been the bottoming out of reported low prices and growing number of carriers positioning themselves at the lower end of the price range. In Q2 2025, the lowest 100 GigE prices on offer in the most competitive markets remained steady at $0.05 per Mbps per month. The lowest for 10 GigE also held at $0.07 per Mbps per month.

In 2025, providers indicated that a majority of their sales mix in key U.S., European, and Asian hubs were now 100 GigE. But carriers in these hubs are also in the process of rolling out 400 GigE services across their network, and customer demand has started to materialize.

At the moment, providers report that the service represents a very small portion of their sales mix (think single digits) and is mainly limited to the largest global hubs in Europe and the U.S. Across key cities in the U.S. and Europe, 400 GigE prices range from $0.08 to $0.09 per Mbps. That’s an average of 3.3 times the price of a 100 GigE port across key cities. As networks scale to meet increasing demand, price erosion for IP transit remains a certainty in nearly all markets for the foreseeable future.

Get More IP Networks Pricing Data

You’ll find more research like this in our IP Networks Research Service: the most complete source of data and analysis about international internet capacity, traffic, service providers, ASN connectivity, and pricing.

Download the executive summary of the analysis to get an overview of the new research.

Brianna Boudreau

Senior Research Manager Brianna Boudreau joined TeleGeography in 2008. She specializes in pricing and market analysis for wholesale and enterprise network services with a regional focus on Asia and Oceania. While at TeleGeography, Brianna has helped develop and launch several new lines of research, including our Cloud and WAN Research Service.