Nigeria is home to Africa’s biggest mobile market by some distance, with 217.5 million subscriptions at the end of 2023, up from 209.5 million a year earlier.

The next largest African markets at end-2023 were South Africa with 118.9 million subscriptions, and Egypt with 111.1 million, according to TeleGeography’s GlobalComms Database.

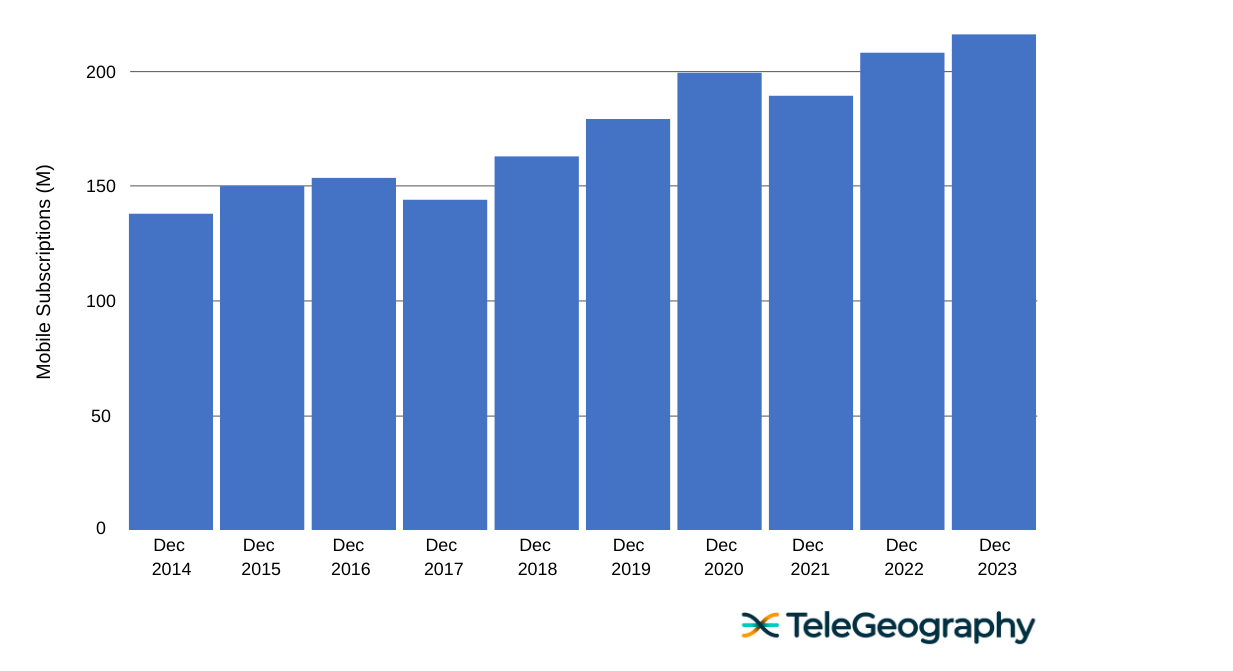

Following years of strong growth, the Nigerian mobile sector registered its first annual contraction in 2017. Nigeria’s number of subscriptions dropped by 6.2% that year, due to a SIM registration campaign that resulted in the disconnection of millions of inactive or incorrectly registered accounts.

Growth resumed in Q4 2017, averaging an annual rate of 11% for the following three years. By end-2020, Nigeria reached 200.7 million active SIMs.

Rapid growth came to a halt in 2021, however, following the implementation of new regulations to force all mobile phone users to update their registration with their National Identity Number (NIN). This move also saw the sale and activation of new SIMs for all operators temporarily suspended from December 2020 until the following April.

As such, the market total declined by 5% in 2021. In early April 2022, the NIN-SIM linkage exercise came to an end, allowing the annual growth rate to rebound to 10%. The subscription total rose a more modest 4% in 2023.

Recent Growth

Nigeria, Mobile Subscriptions Growth 2014-2023

Although well ahead of other African countries in terms of subscription volume, when it comes to population penetration, Nigeria sits 30th out of 57 countries, with a figure of 96%.

While that statistic may look reasonable, there are still tens of millions of Nigerians without connectivity. The penetration rate is boosted by the large numbers of users who own two or more SIM cards in order to take advantage of on-network airtime deals.

The operating environment poses a number of significant challenges, including worsening economic conditions, inadequate power supply, fuel shortages, multiple taxation, vandalism of network infrastructure, currency depreciation, and heightened instability in several regions.

Operators have complained that they are struggling to cope with huge energy price rises, with energy now accounting for around 40% of operating costs, according to some estimates.

MTN in First Place

South African-owned MTN leads the sector, controlling 36.6% of all Nigerian mobile users at the end of 2023 with 79.7 million subscriptions.

MTN has maintained its number one position despite regulatory measures adopted by the Nigerian Communications Commission (NCC) to mitigate its significant market power, as well as recent moves by the operator itself to disconnect millions of subscriptions with incomplete registration documents.

The latter decision was prompted by the hefty fine MTN received in October 2015 for failing to meet a deadline to disconnect around 5.1 million unregistered SIMs. The initial NGN1 trillion ($5.2 billion) penalty was eventually negotiated down to NGN330 billion by mid-2016.

As part of the settlement arrangement for the fine, MTN Nigeria committed to listing a portion of its shares on the Nigeria Stock Exchange. This eventually took place in May 2019 via a “listing by introduction,” followed by a public offer at the end of 2021, which saw MTN Group’s shareholding in its Nigerian unit reduced from 78.8% to 75.6%.

The cellco’s performance in recent years has also been severely impacted by the suspension of regulatory services by the NCC, which restricted the introduction of any new tariff plans and promotions until March 2016. Additional contributing factors include economic conditions and the limited availability of U.S. dollars.

Three Main Rivals

MTN is not the only Nigerian operator facing significant challenges to its business.

MTN is not the only Nigerian operator facing significant challenges to its business.

9mobile—the country’s fourth largest cellco by subscriptions—was forced into a rebranding in July 2017 and the subsequent sale of its operations.

After defaulting on a $1.2 billion loan due to an economic downturn, currency devaluation, and dollar shortages, talks with banks failed to bring a resolution. UAE-based investors Mubadala Development Company and Etisalat Group (now e&) then pulled out, forcing Etisalat Nigeria to rebrand to 9mobile.

The Teleology Nigeria consortium emerged as the preferred bidder for 9mobile in February 2018 with an offer of $301 million, beating the only other participant, Smile Telecoms. However, by early 2019, shareholder disagreements saw some investors walk away.

All of this had a notable impact on 9mobile’s subscription base, leaving it well behind its three larger rivals with a market share of just 6.4% at end-2023.

MTN Out Front

Nigerian Mobile Market, December 2023

.png?width=1280&height=729&name=Nigerian%20Mobile%20Market%2c%20December%202023%20(1).png)

The second and third-placed players are virtually neck-and-neck in subscription terms.

Indian-owned operator Airtel Nigeria claimed 61.8 million subscriptions and 28.4% of the market as of December 2023. Originally launched under the name Econet Wireless Nigeria in December 2000, the cellco subsequently came under the control Kuwait’s Zain Group.

In March 2010, Bharti Airtel of India agreed to acquire the majority of Zain Group’s African assets in a $9 billion deal that included Zain Nigeria. The takeover concluded in June 2010 and Zain Nigeria was rebranded under the Airtel moniker by the end of that year.

Close rival Globacom, which trades under the Glo name, is majority owned by Nigerian petrochemical firm Conpetro. Globacom was awarded Nigeria’s second national operator license in August 2002 and received the country’s fourth nationwide GSM concession as part of the bundle.

Glo could claim 28.3% of the total market at end-2023, with 61.6 million subscriptions.

Rounding out the sector are a handful of small 4G and 5G operators with negligible market shares. They include Smile Communications, which was founded in 2008 by pan-African operator Smile Telecoms Holdings and awarded a license in July 2009. It took Smile until February 2013 to launch its FDD-LTE network.

Ongoing Problems

Nigeria’s mobile operators frequently face complaints from both the NCC and consumers over poor quality of service and network congestion, but in turn have claimed that vandalism of infrastructure, multiple taxation, and inadequate power supply hamper their efforts to operate effectively.

Furthermore, heightened instability and unrest in several parts of the country have limited the ability to carry out routine maintenance and emergency repairs.

Furthermore, heightened instability and unrest in several parts of the country have limited the ability to carry out routine maintenance and emergency repairs.

Airtel’s infrastructure was badly affected by insurgents in the northeast in early 2020, and MTN’s network was restricted in the northern states at the end of 2021 to address security issues.

In the absence of a reliable electricity grid, base stations need to be served by generators and powered by diesel. In addition, telecom companies continue to face multiple taxation at local, state, and federal level, with service disruptions related to tax claims said to cost the industry millions of dollars annually.

The Association of Licensed Telecommunications Operators of Nigeria warns that local government agencies frequently threaten to shut down base stations in a number of states if companies fail to pay numerous taxes and levies. MTN, for one, says it has suffered arbitrary enforcement actions and service disruptions by parties working on behalf of tax-raising bodies.

All of these issues certainly make the Nigerian mobile market one to watch.

Pete Bell

Pete Bell is a Senior Analyst for TeleGeography’s GlobalComms Database and also contributes to the daily CommsUpdate newsletter. He has a particular interest in wireless broadband and was responsible for TeleGeography’s 4G Research Service until it was integrated into GlobalComms.