When it comes to the nature of exploration, there are typically a number of underlying forces at play, some positive and some negative.

The “pioneering spirit” could be inspired by the excitement of new opportunities, or by the pressure of existing difficulties.

The data center market happens to be dealing with both of those sentiments right now, with several factors driving it to new places.

Let’s explore the APAC frontier, for example.

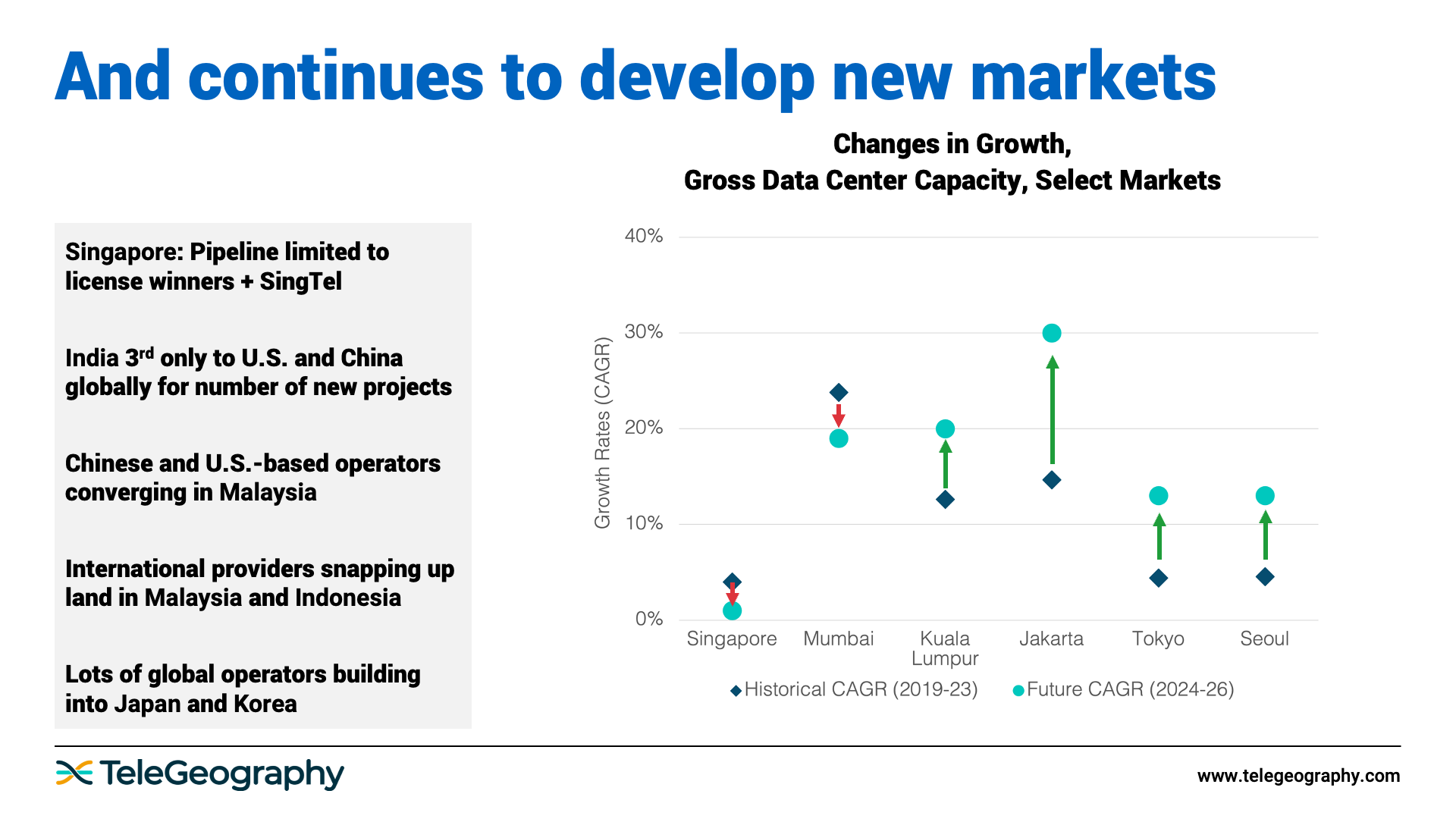

Below, you'll see five-year growth in the aggregate capacity of seven major APAC hubs.

Since the moratorium in Singapore, new growth has pretty much dropped off. On the opposite side, we’ve already seen staggering growth in new capacity in Mumbai, Kuala Lumpur, and Jakarta.

If we look at the trajectory going forward, a few things stand out.

When comparing historical growth to future growth, Singapore drops even further. Of course, this will depend on the rollout timelines of the projects that have been approved under the new licensing regime.

Singapore is, by far, the most critical market in Southeast Asia and there's just no way to get new facilities built outside of this very limited approval process.

Mumbai also drops a little bit in terms of its growth over the next three years, but it’s still a very large market. In fact, if we look at India as a whole, it's third only to the U.S. and China when it comes to the number of projects in the pipeline.

As relations between China and the West ice over a bit, we see a convergence of Chinese, U.S. and other international operators entering Southeast Asia—Malaysia and Indonesia in particular—with multiple projects in development.

It’s interesting to see what’s happening North Asia as well. Although Japan is one of the world’s biggest markets, it has traditionally been a difficult market to enter. We’re now seeing real momentum with new international investment. A similar phenomenon is happening in Seoul.

As opportunities for new growth slow significantly in Singapore and Hong Kong, there is a tremendous surge of growth driven by local companies, joint ventures, and international players all at once in multiple areas of Asia.

As opportunities for new growth slow significantly in Singapore and Hong Kong, there is a tremendous surge of growth driven by local companies, joint ventures, and international players all at once in multiple areas of Asia.

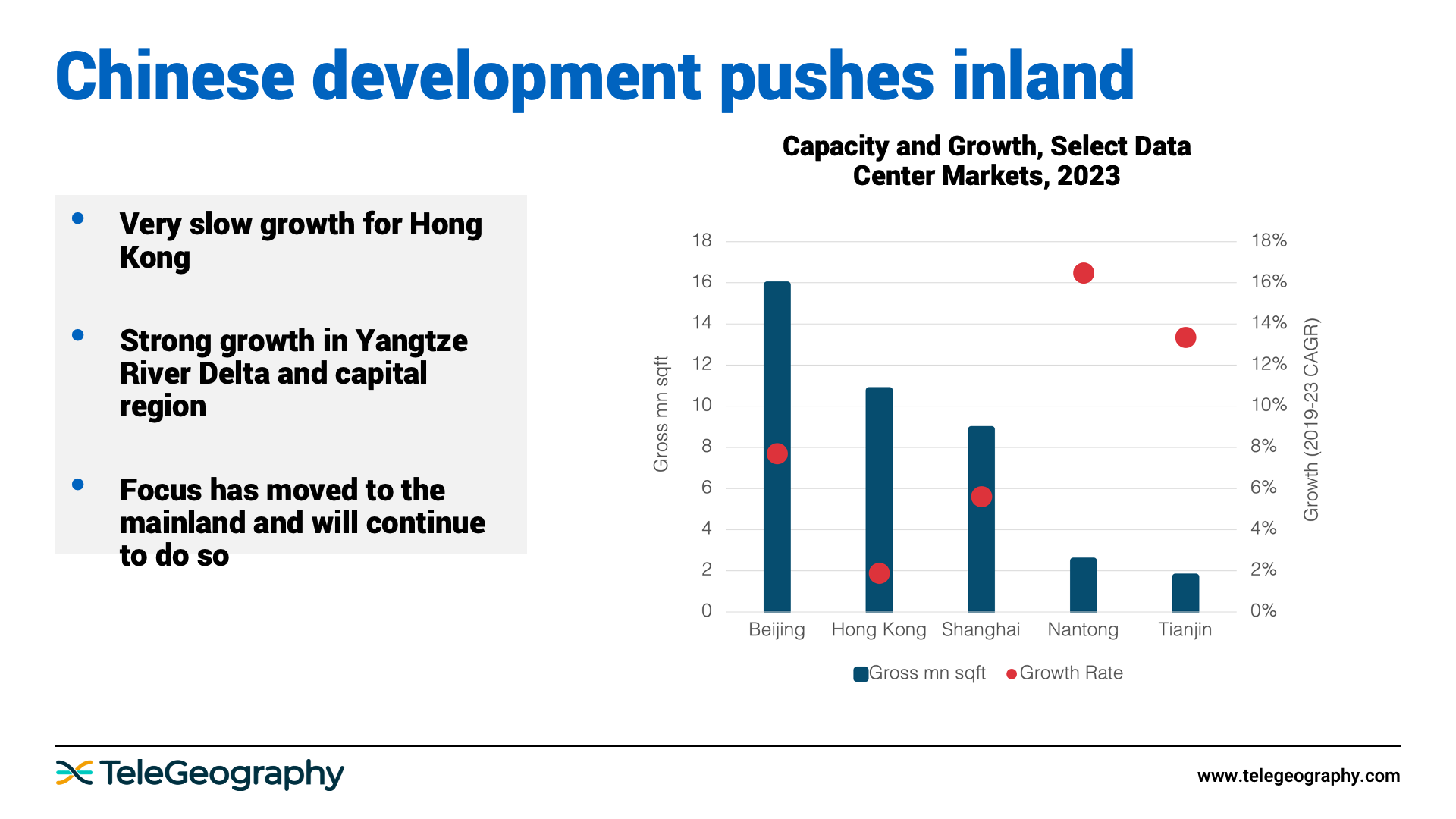

Now, let's take a moment to look at what's going on in China in particular.

In Hong Kong—the primary hub in this region—growth has slowed significantly, coinciding with the protests of 2019 and the actions taken thereafter.

Meanwhile, growth has been surging into the mainlands over the last few years, particularly in the Yangtze River Delta and capacity region. Based on what's happening in the pipeline, this trend will continue.

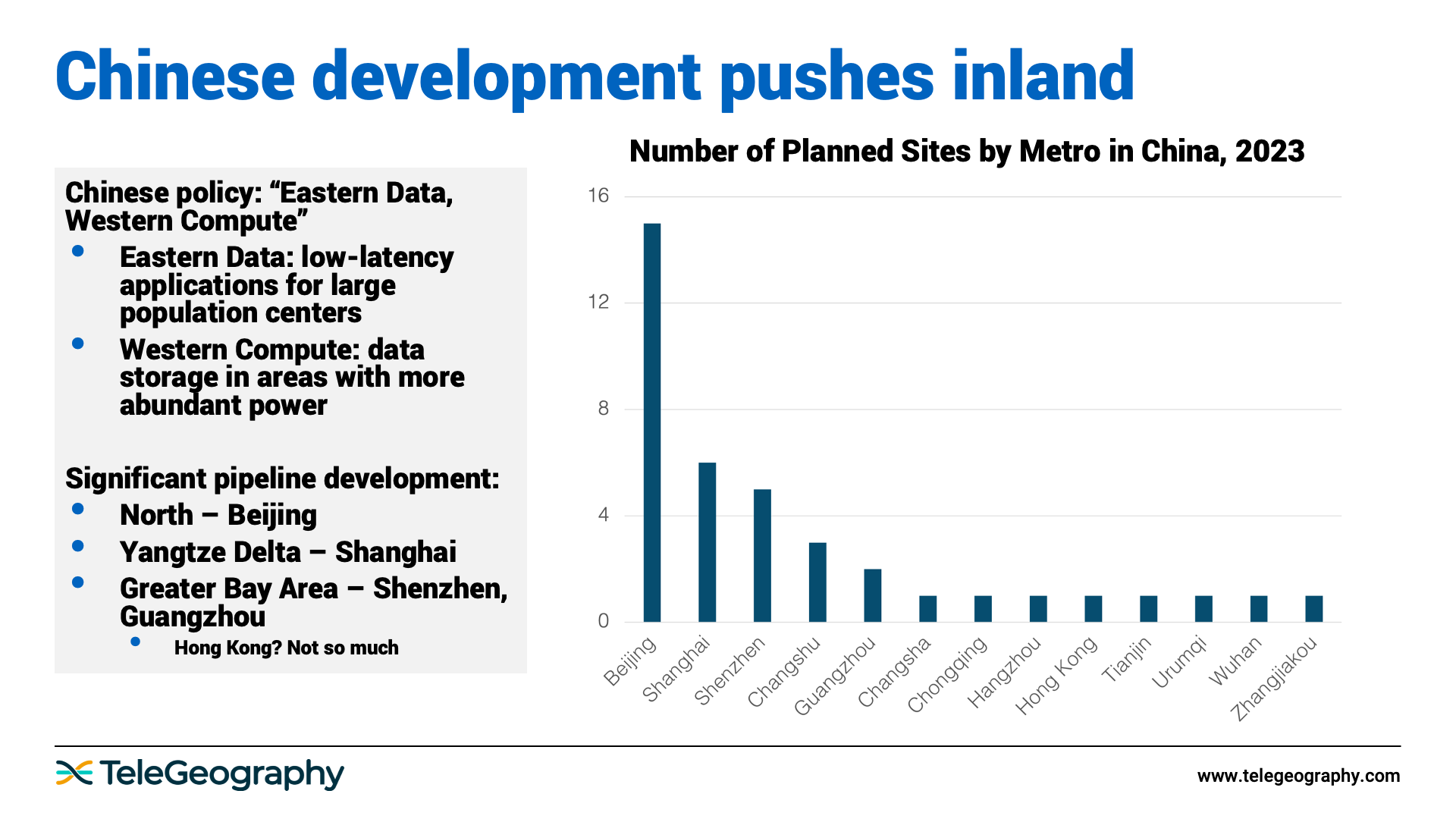

If you haven’t heard of the Chinese policy “Eastern Data, Western Compute,” there’s a mandate to set up multiple zones of data center interconnection. The East is primarily devoted to low-latency applications for high population markets, while the West is being set up for data storage in areas with more abundant, and cheaper, power.

In the Eastern zones, tons of development is happening right now. There has been significant pipeline development in the capital area, in the Yangtze Delta area, and in the Greater Bay Area, but not so much in Hong Kong.

As new infrastructure investment in Hong Kong diminishes, China’s focus moves further into the mainland.

Is Power the New Gold?

Jon Hjembo

Senior Research Manager Jonathan Hjembo joined TeleGeography in 2009 and heads the company’s data center research, tracking capacity development and pricing trends in key global markets. He also specializes in research on international transport and internet infrastructure development, with a particular focus on Eastern Europe, and he maintains the dataset for TeleGeography’s website, internetexchangemap.com.