The US cable TV and broadband sector has undergone a major period of consolidation in the last six months, signaling big changes in the market’s DNA.

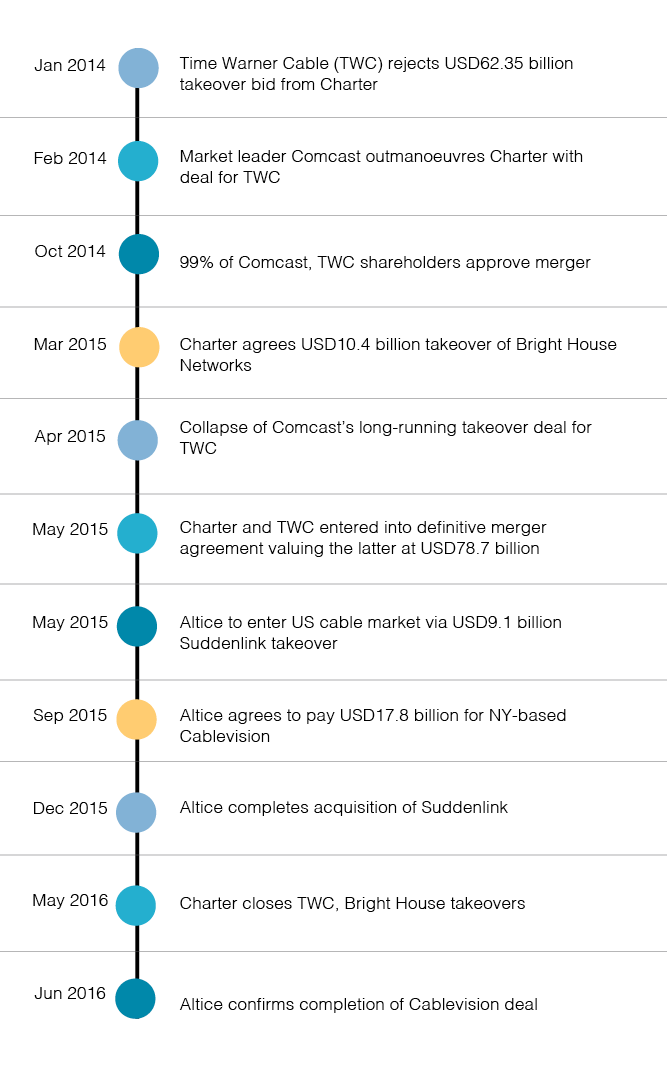

Case in point: Charter Communications completed takeovers of Time Warner Cable (TWC) and Bright House Networks in May this year, while the Amsterdam-based telecoms investment firm Altice finalized buyouts of Suddenlink and Cablevision in December 2015 and June 2016, respectively.

Although long-time market front-runner Comcast still leads the way in cable broadband subscribers, Charter’s acquisitions push it to the number two spot, with more than 35% of all cable Internet users by end-June 2016.

The two Altice deals put it in fourth place just behind Cox Communications. Combined totals for Suddenlink and Cablevision give Altice around 6.7% of the overall cable market in customer terms.

US Cable Broadband Market Shares by Subscribers - June 2016

Comcast had previously been looking to boost its presence in the market, agreeing to a takeover of TWC in February 2014. The USD45.2 billion deal collapsed in April 2015, having spawned opposition from the US Justice Department and Federal Communications Commission (FCC) due to the potential threat to competition posed by the emergence of such a giant in the market.

The deal would have created an operator with around two-thirds of all cable broadband customers in the US.

TWC had earlier knocked back a “grossly inadequate” USD37.3 billion offer from Charter in January 2014; in May 2015 Charter confirmed its dual move for TWC and Bright House. While it agreed to pay USD10.4 billion for Bright House, it also increased its offer for TWC to USD195.71 for each TWC share – well up on its prior bid of USD132.50 per share.

The two buyouts received the green light from the FCC in May 2016 and were completed later that month.

Prior to its entry into the US market, the Altice group had cable and mobile operations in France, Belgium, Portugal, Israel, the Dominican Republic and French Overseas Territories in the Caribbean and Indian Ocean. Its USD9.1 billion move to take a 70% stake in the seventh-largest US cableco, Suddenlink, was made in May 2015 and completed at the end of that year. September 2015 brought with it the announcement that Altice was looking to add to that deal, with a USD17.8 billion swoop for New York-based Cablevision. That buyout was finalized in June 2016, with the two cablecos now forming part of Altice USA.

At the end of the day, cable broadband users account for around 57% of all high speed Internet users in the US. Comcast claims around 24 million users; the enlarged Charter has around 21 million, Cox 5 million and Altice 4 million. The main non-cableco broadband providers are AT&T with 16 million users, Verizon with 9 million and CenturyLink with just over 6 million.

As cut throat competition continues, there may very well be more consolidation in the cards.

Timeline of Major US Cableco Deals 2014-2016

Pete Bell

Pete Bell is a Senior Analyst for TeleGeography’s GlobalComms Database and also contributes to the daily CommsUpdate newsletter. He has a particular interest in wireless broadband and was responsible for TeleGeography’s 4G Research Service until it was integrated into GlobalComms.