SD-WAN's core promise of optimizing network performance through load balancing—and cutting costs by integrating internet into the WAN—has proven attractive. And it's helped the service take root among many large enterprise network teams.

Offerings from SD-WAN suppliers have become more sophisticated, with new features and management levels.

At the same time, the market is consolidating with notable mergers and acquisitions.

This excerpt from our SD-WAN Research Service combines pricing and vendor analysis with SD-WAN findings from our latest WAN Manager Survey to paint a full picture of the current SD-WAN landscape.

A New Approach to Architecture

SD-WAN has revolutionized the way that enterprises approach network architecture. And the technology has become a critical tool in ensuring the resilience and performance of corporate WANs.

Early adopters cite cost savings and leveraging multiple transport technologies as the main drivers for considering the service.

But motivation has shifted among more recent SD-WAN converts.

Customers are now looking for an application-aware network with optimal performance. As a result, a next generation of SD-WAN services has emerged.

Customers are now looking for an application-aware network with optimal performance. As a result, a next generation of SD-WAN services has emerged.

These services emphasize more than the technology itself. They also focus on the intelligence and extra service features built into SD-WAN that enable more efficient routing and virtualization. And as COVID-19 created a sudden, dramatic shift to working from home in 2020, SD-WAN suppliers enhanced and rolled out remote access solutions to keep enterprise customers securely and reliably connected.

In previous years of our analysis, a majority of the WAN managers we spoke with were evaluating the promise of the technology itself and selecting a vendor.

Today, a sizable portion have or are in the process of rolling out SD-WAN across their global network. As such, they face a new set of issues in procuring, securing, and operating the network.

Today, a sizable portion have or are in the process of rolling out SD-WAN across their global network. As such, they face a new set of issues in procuring, securing, and operating the network.

For companies still in the supplier selection phase, the long list of vendors and managed service providers offering SD-WAN can be difficult to compare. The challenge lies within deciding which supplier meets individual network requirements and imparts the best value for the investment.

With a number of mergers and acquisitions over the past year alone, ensuring vendor longevity has become critical in this process.

SD-WAN Deployments Rapidly Increasing

As the technology matures, the number of enterprises deploying SD-WAN has rapidly increased.

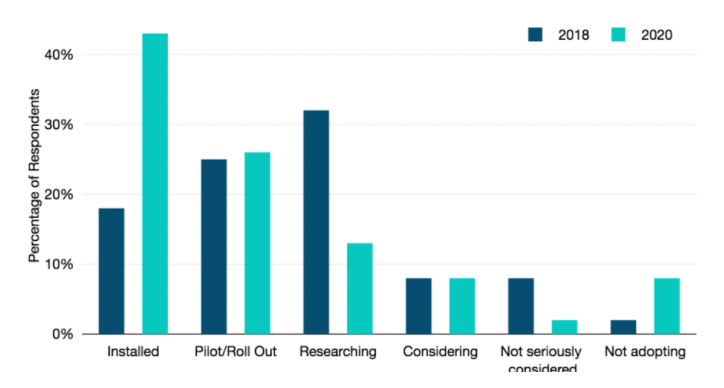

The figure below compares where respondents to our WAN Manager Survey were in the process of researching and adopting SD-WAN in 2018 (the dark blue columns) versus 2020 (the turquoise columns).

There have been some notable shifts over the past two years:

- Only 18% of respondents reported they had installed SD-WAN on at least part of their network in 2018. In 2020, 43% of respondents indicated they had installed the service, a sizable increase.

- The percentage of end-user respondents that were in the pilot or rollout phase has largely stayed the same (at about 25%).

- The number of respondents researching the service dropped from 32% to just 13% over the past two years. This is likely a reflection of the respondents who have installed the service. But it also points to the momentum that the service has garnered amongst enterprise customers in a short period of time.

Regardless of whether an enterprise has already implemented SD-WAN or is earlier in the adoption process, supplier selection is a critical first step to making the technology effective in the network.

SD-WAN Stage of Adoption, 2018 vs. 2020

You can explore all of TeleGeography’s WAN content over here. And our SD-WAN Vendor Guide can be downloaded here.

Greg Bryan

Greg is Senior Manager, Enterprise Research at TeleGeography. He's spent the last decade and a half at TeleGeography developing many of our pricing products and reports about enterprise networks. He is a frequent speaker at conferences about corporate wide area networks and enterprise telecom services. He also hosts our podcast, TeleGeography Explains the Internet.