With an estimated 750 million active subscriptions at the end of September 2023, China has the world’s largest 5G mobile market by far.

It’s more than three times the size of the next largest market, the U.S., which had around 212 million 5G subscriptions at the same date, according to TeleGeography’s GlobalComms Database.

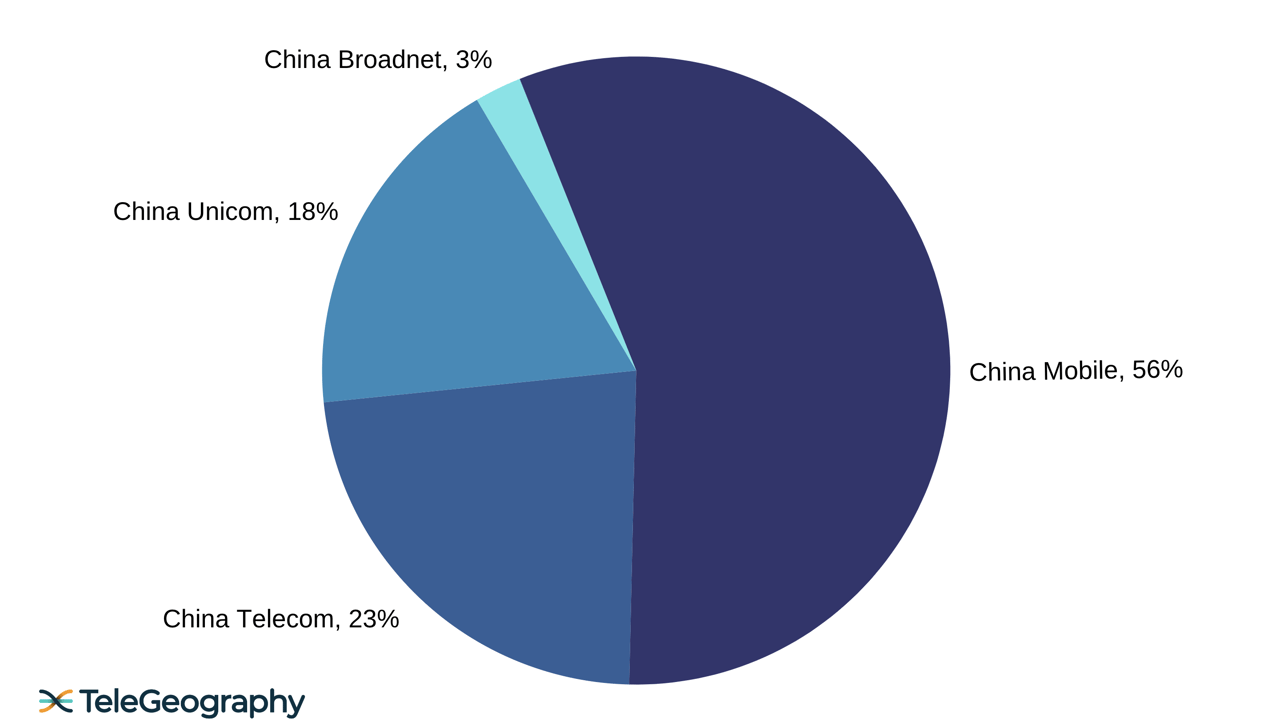

The sector is served by four players: well-established mobile network operators (MNOs) China Mobile, China Telecom, and China Unicom, plus newcomer China Radio and Television, which launched in 2022 under the name China Broadnet.

Four Providers

China 5G Market Shares, June 2023

All four companies have the Chinese government as a majority shareholder.

5G Background

With LTE penetration rapidly approaching saturation, by 2018, the nation’s cellcos had turned their attention toward 5G.

Mirroring China Mobile’s successful strategy with 4G, China Mobile, China Telecom, and China Unicom all participated in the international standard-setting process for the nascent technology. The three MNOs partnered with vendors to test a variety of fifth-generation technologies, working alongside the ITU and specifications body 3GPP.

Unlike 4G, however, the firms dedicated a substantial portion of their efforts toward industrial use cases for 5G, in areas ranging from telemedicine to manufacturing and smart city operations. This was partly at the behest of the government, which sees 5G as a potential economic multiplier that could help accelerate development in sectors not directly connected to telecoms.

In December 2018, the Ministry of Industry and Information Technology awarded 5G trial concessions to each of the three incumbent operators, which lost little time switching on their 5G networks. All three launched commercial services on October 31, 2019, initially covering 50 cities.

By the end of 2019, China Mobile had deployed 50,000 base transceiver stations (BTS), while Unicom and Telecom reported 60,000 sites each.

For further 5G network construction, Telecom and Unicom have partnered to jointly develop infrastructure, and China Mobile has teamed up with newcomer China Broadnet.

By end-2022, Telecom and Unicom had deployed a combined total of more than 1 million 5G BTS, while China Mobile had rolled out 1.29 million sites, including 480,000 with China Broadnet.

By end-2022, Telecom and Unicom had deployed a combined total of more than 1 million 5G BTS, while China Mobile had rolled out 1.29 million sites, including 480,000 with China Broadnet.

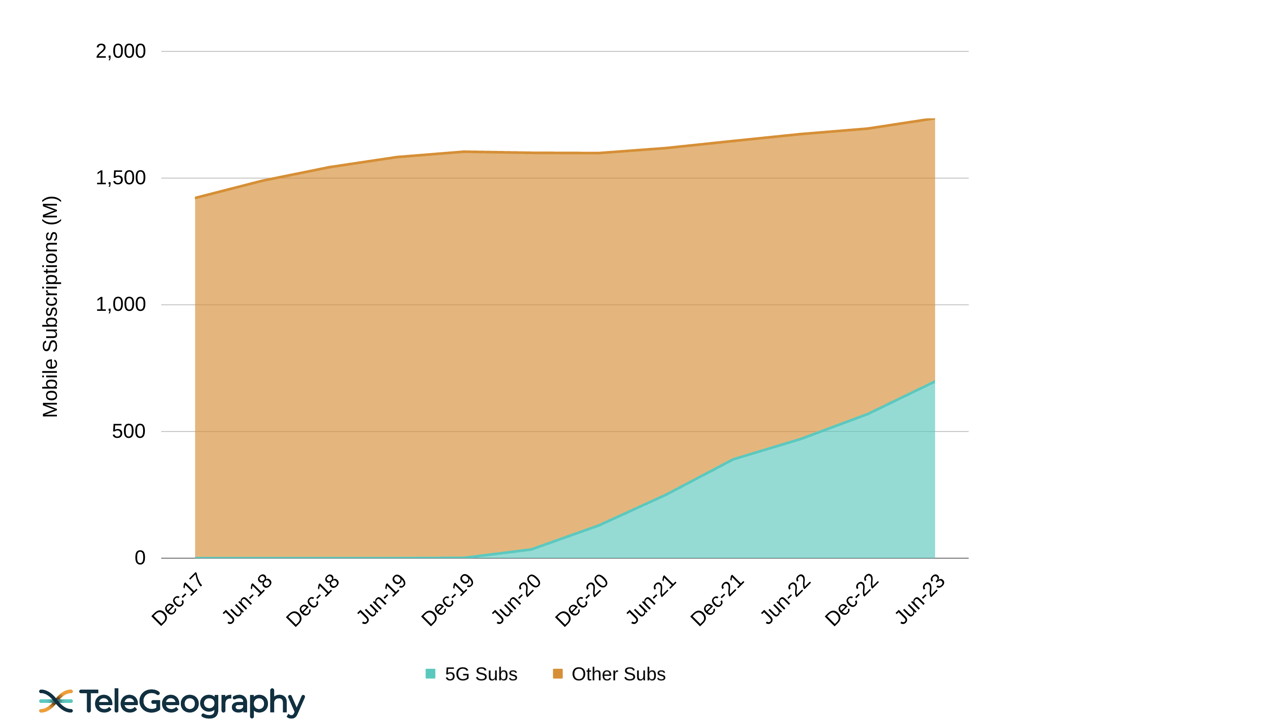

Rapid Take-up

Although the newly launched 5G networks accounted for only 0.1% of China’s mobile subscription total (1.6 billion) by the end of 2019, take-up began to improve in the second half of the following year.

There were around 129 million 5G subscribers at the end of 2020, equivalent to 8% of the overall mobile market. This number rose to 390 million twelve months later (24% of the market).

40% of Mobile Market

5G Growth in China

The 5G total jumped to around 570 million by end-2022—34% of all mobile subscriptions. By mid-2023, it had reached almost 700 million, with two-fifths of all mobile subscriptions now via 5G.

It should be noted that the data reported by the MNOs—with one exception—counts the number of “5G Package Subscribers.” This includes users that do not utilize the 5G network but have signed up to an appropriate plan. There are many customers outside of the 5G networks’ coverage areas, or without a compatible device, that have chosen a 5G service plan to take advantage of certain discounts or other benefits.

According to the providers, there were a total of 1.27 billion 5G package subscribers at the end of June 2023, up from 927.5 million a year earlier.

The only MNO to give a true 5G network subscription count is China Mobile, which had 722 million 5G Package subscribers as of mid-2023, but just 393 million active 5G network subscriptions at the same date.

The Road to 5.5G

In January 2024, China Unicom and equipment partner Huawei deployed a pilot large-scale 5.5G network in Beijing, covering three key areas: Beijing Financial Street, the Beijing Long Distance Call Building, and Workers’ Stadium. According to the vendor, the trial system provided continuous experience of more than 5Gbps and achieved a peak download rate of 10Gbps.

Huawei added that the network utilized high and low-band coordination under discontinuous coverage to enable “seamless handovers and uninterrupted service.” Demonstrations on the pilot network showcased applications including glasses-free 3D, ultra-high definition real-time broadcasting, and extended reality (including virtual reality and augmented reality).

Looking ahead, the GlobalComms Forecast Service expects China to be home to almost 1.3 billion 5G network subscriptions by the end of 2025. At this point, the technology will account for more than 70% of the overall mobile market.

Pete Bell

Pete Bell is a Senior Analyst for TeleGeography’s GlobalComms Database and also contributes to the daily CommsUpdate newsletter. He has a particular interest in wireless broadband and was responsible for TeleGeography’s 4G Research Service until it was integrated into GlobalComms.