Earlier this week, I joined Ciena and Telstra for a live webinar highlighting Asia-Pacific market drivers, trends, and new cable builds.

During my session, which focused on Trans-Pacific submarine cable trends, content providers came up quite a bit.

These companies prioritize the need to link their data centers and major interconnection points. As such, they often deploy massive amounts of capacity on core routes.

The Trans-Pacific and Intra-Asia routes are two great examples.

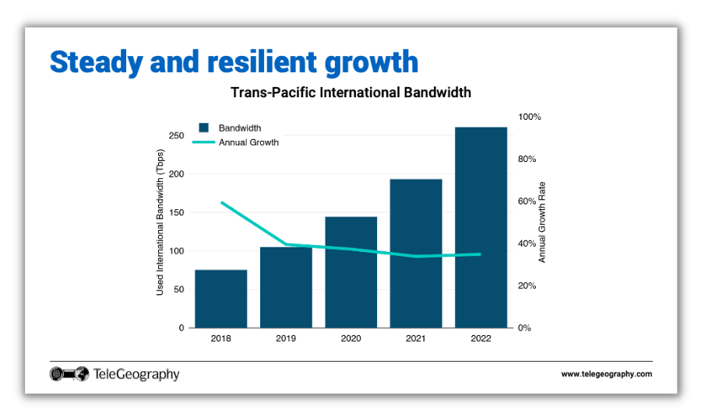

I began my presentation by showing Trans-Pacific international bandwidth from 2018 to 2022.

This chart shows that bandwidth demand growth across the Pacific has remained resilient and rather steady over the years. Trans-Pacific bandwidth grew 35% year-over-year in 2022 alone, reaching just over 250 Tbps of capacity.

Although the turquoise line shows a dip in annual growth before stabilizing in 2019, the more important takeaway is the absolute increase in healthy bandwidth growth over the years.

And who is consuming all of this bandwidth?

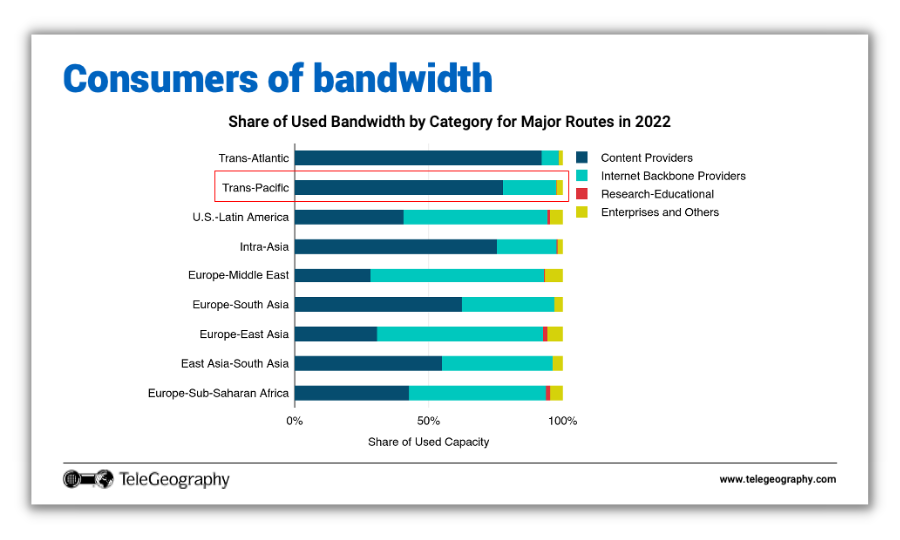

The slide below breaks down four different categories of bandwidth users—Content Providers, Internet Backbone Providers, Research-Educational, and Enterprises and Others—across several major routes.

We can see that bandwidth usage is not evenly distributed across these categories.

Content providers, shown in navy blue, take up huge shares of capacity across the Pacific and Intra-Asia (approximately more than 78% and 75% of bandwidth, respectively).

On the flip side, internet backbone providers (turquoise), still consume larger volumes of bandwidth on certain routes, like U.S.-Latin America, Europe-Middle East, etc.

With that being said, we anticipate a general increase in content provider share of bandwidth across most of these routes in the years to come. Demand from other types of users is also growing, just not as fast as content provider demand.

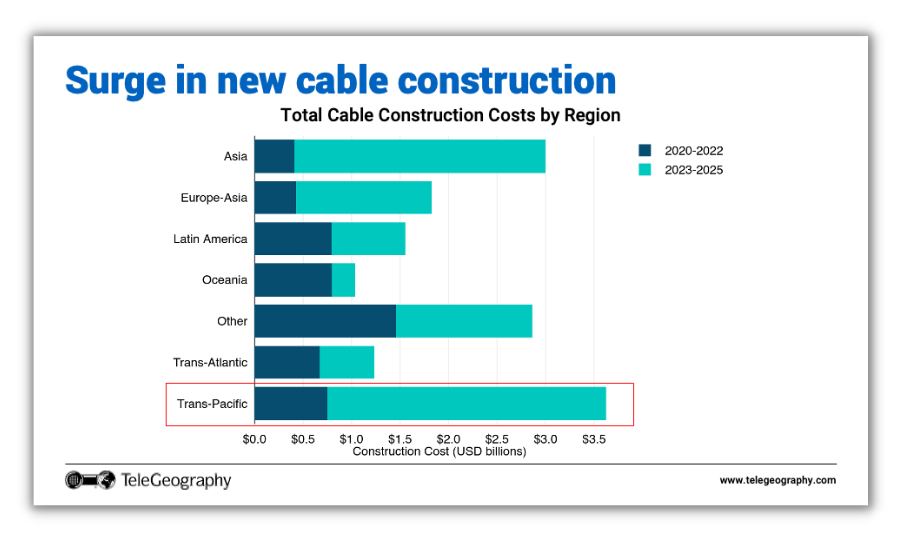

Unsurprisingly, the increase in bandwidth demand has led to a surge in new cable investment.

Unsurprisingly, the increase in bandwidth demand has led to a surge in new cable investment. As we can see in the figure below, there are a lot of cables entering service in the next three years.

Focusing on the Trans-Pacific alone, the construction value for cables entering service from 2023-2025 is significantly higher compared to 2020-2022.

We also witness similarly high levels of cable investment in Asia—also known as Intra-Asia—as there is a need to distribute this capacity within the region. Note that there may be more, unannounced cables on the horizon, which may further inflate these values.

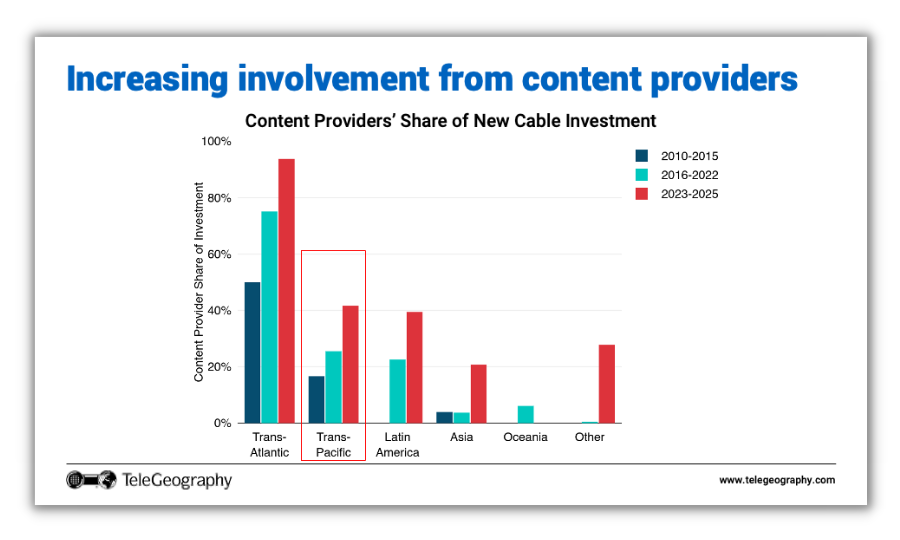

Earlier in my presentation, I established that content providers consume more bandwidth on certain routes.

If we break down content provider investment in new cables by time period, we see increases across the board.

Nearly half of all Trans-Pacific cable investments entering service between 2023-2025 are backed and funded by content providers.

Nearly half of all Trans-Pacific cable investments entering service between 2023-2025 are backed and funded by content providers.

And we believe that this trend is likely to increase in the future.

Next, my presentation covered why global price erosion is slowing, the reality of U.S. and China decoupling, and an overview of all old and new cable systems across the Pacific.

Marvin Tan

Marvin Tan is a Senior Research Analyst at TeleGeography. Based in Singapore, he's part of the company’s infrastructure research team, focusing primarily on submarine cables, terrestrial networks, and internet infrastructure in Asia Pacific.