Swedish equipment vendor Ericsson could face a backlash in China following Sweden’s 2020 decision to ban cellcos from using Huawei gear in 5G networks.

Huawei Risk

Authorities have raised concerns in a number of countries—led by the U.S.—that Huawei’s links to the Chinese government could pose a national security risk due to the potential for espionage and network disruption.

In 2018, the U.S. barred the government and its contractors from purchasing Huawei equipment. And in May of the following year, Huawei and 68 affiliated companies were added to the Department of Commerce’s Bureau of Industry and Security Entity List, which effectively blocked the use of any of its gear in U.S. networks.

In 2018, the U.S. barred the government and its contractors from purchasing Huawei equipment. And in May of the following year, Huawei and 68 affiliated companies were added to the Department of Commerce’s Bureau of Industry and Security Entity List, which effectively blocked the use of any of its gear in U.S. networks.

Huawei, the world’s largest equipment supplier, has repeatedly denied that it poses any security risk, and has said it’s willing to sign “no-spy” agreements with foreign governments.

Swedish Ban

In October 2020, when announcing the terms for its forthcoming auction of 5G spectrum licenses, Sweden’s Post and Telecom Agency (Post & Telestyrelsen, PTS) said that Huawei and fellow Chinese vendor ZTE would be barred from providing equipment for 5G core, transmission, and radio access networks. The decision was made after consultation with the armed forces and security service.

Huawei launched an appeal against the ruling; the regulator was forced to postpone the auction while the matter was examined by the courts.

The spectrum sale—which was for frequencies in the 2.3GHz and 3.5GHz bands—eventually took place in January 2021. The Court of Appeal decided that it could proceed pending the hearing.

In the meantime, Huawei said that it would be willing to work with Swedish authorities to reach a compromise. The vendor complained that the initial ban was imposed without it having had a chance to respond to any security concerns.

Europe: An Key Market for Huawei

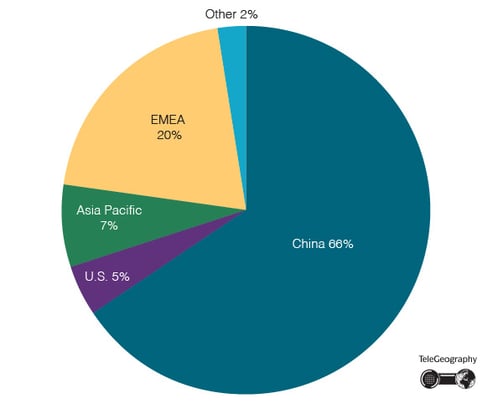

Huawei 2020 Revenues by Region

While its domestic market accounts for the bulk of its business, around 20% of Huawei’s revenues came from the Europe, Middle East, and Africa (EMEA) region in 2020. It will certainly be keen to avoid wider sanctions across Europe.

Its appeal hearing in Sweden began in April this year.

Kenneth Fredriksen, Huawei’s executive vice president for Central East Europe and Nordic Region, said: “Now we will have the opportunity to explain ourselves and let our opinions be heard in a proper way and also deal with all the legal mistakes we believe have been made.”

A verdict is expected soon and could have major ramifications for Ericsson.

Ericsson Fears

Following the news of Sweden’s ban on Huawei and ZTE equipment, the Chinese government warned that there could be a “negative impact” for Swedish companies, with Ericsson certainly in the crosshairs. In a statement released in January, Beijing said “China urges Sweden to immediately correct the mistake and meet China halfway and find solutions on the basis of preserving China-Sweden economic and trade cooperation.”

Major 5G Player

Ericsson’s 5G Business by the Numbers

| 65 publicly announced contracts |

| 139 commercial agreements |

| 86 live 5G networks |

| 43 countries |

| Customers Include: China Mobile, China Telecom, China Unicom, AT&T, DT/T-Mobile, Etisalat, KDDI, MTN, O2, Orange, Telefonica, Telenor, Telia, Vodafone |

Ericsson derives around 10% of its earnings from China, so the imposition of tit-for-tat sanctions would be no laughing matter.

Indeed, it emerged in January 2021 that Ericsson had lobbied the Swedish government in an effort to have the Huawei and ZTE ban overturned. The vendor’s Chief Executive Officer Borje Ekhol had a series of phone calls with trade minister Anna Hallberg, although she responded by saying that she wouldn’t step in to influence the PTS decision. The CEO had previously said that the ban restricted free trade and competition.

It’s been reported that the Ericsson executive has even threatened that his company could move its base from Sweden to protect its Chinese business.

Other Countries

Sweden is not alone in its stance toward Chinese tech firms.

In July 2020, the U.K. government ordered that all Huawei equipment be removed from the country’s 5G networks by the end of 2027 while buying new Huawei 5G gear has been blocked since the end of last year. This came despite the admission that the move could delay 5G rollouts by up to two years and increase costs by as much as £2 billion.

A ban on using Huawei equipment in sensitive, critical parts of UK mobile networks had already been in place for some time.

Nokia, the third of the world’s big three mobile equipment vendors, is in a slightly better position than Ericsson. Its home country of Finland hasn’t barred Huawei equipment outright, although legislation has been produced that would permit a ban if authorities have “serious grounds for suspecting that the use of the device endangers national security or national defense.”

Huawei responded by saying that the Finnish approach was more realistic than that of Sweden, “focusing on equipment instead of vendors.”

Pete Bell

Pete Bell is a Senior Analyst for TeleGeography’s GlobalComms Database and also contributes to the daily CommsUpdate newsletter. He has a particular interest in wireless broadband and was responsible for TeleGeography’s 4G Research Service until it was integrated into GlobalComms.