Many of us are still trying to decide whether 2021 felt like ten years or six months, but there is no doubt that aspects of it were extensions of 2020.

This was no exception in the WAN world, where we saw many trends continue, such as SD-WAN rollouts, expansion of local internet breakouts, and most enterprises continuing to have a large portion of workers staying home and connecting remotely.

My colleague Elizabeth Thorne and I had a great conversation about key corporate network trends at the end of the year—now it's time to dive into the hard data.

Remote Work

The future of the office worker is still very much in flux as many large corporations have not yet settled on a return policy and what the balance of home/remote and back in the office looks like. There are still a lot of questions for the IT infrastructure team around issues like optimizing office bandwidth and securing remote access.

While video calls over the internet are far from perfect, we have come to accept and work with the “good enough” quality.

The pandemic offered an unplanned proof of concept for moving most conversations to a video/UCaaS tool over the public internet and how that culture has effectively changed. While video calls over the internet are far from perfect, we have come to accept and work with the “good enough” quality.

WAN managers might need to shut down service at some sites, but still have to manage the multiplicity of endpoints from all of the remote workers connecting to the network. Not to mention that some companies may further decentralize offices out of the traditional major business centers, making sourcing connectivity into a greater challenge for those locations.

Of course, all of this may unfold in slow motion, given that both real estate and WAN contracts tend to be multi-year and enterprise decision-makers seem unlikely to settle on post-pandemic plans in the near future at that.

SD-WAN

The software-defined network has been the headline grabber for the last several years, and interest and rollouts continued to be high during 2021.

This past year, however, was likely the year that a majority of the market (at least of the kind of companies that respond to our surveys) had SD-WAN deployed. As the later adopters have caught up, we have seen a movement away from vendor-direct self-managed SD-WAN toward carrier/MSP deployments for managed service.

While we did not survey on SD-WAN this year, our many conversations with WAN managers indicated that if they did not already have SD-WAN deployed, it was likely on the near horizon. A small percentage (less than one in ten in our 2020 data) don’t ever plan to adopt SD-WAN.

The WAN managers in the camp we have spoken to seem to fall on opposite sides of the spectrum. On the one hand, enterprise networks with extensive sourcing teams, almost acting like mini-carriers that lean on more traditional services such as point-to-point. On the other, technology-first companies that can meet their needs with internet, XaaS, and cloud-based security and don’t even really need a “WAN” in the traditional sense.

Stage of Adoption of SD-WAN (2018 vs. 2020)

.png?width=723&name=Stage%20of%20Adoption%20of%20SD-WAN%20(2018%20vs.%202020).png)

Decline of MPLS

While we have been talking about the decline of MPLS for a long time, in the 2021 iteration of the WAN Manager Survey (to be published shortly after this analysis), we found continued evidence of a real decrease in MPLS utilization across enterprise sites.

For the first time, we saw MPLS go below 50% of average sites in the respondent network at 46%. DIA is catching up at 44%.

What is the average product mix of your WAN sites? (Change, 2018-21)

.png?width=723&name=What%20is%20the%20average%20product%20mix%20of%20your%20WAN%20sites%3F%20(Change%2c%202018-21).png)

While predictions about the future of MPLS have sometimes been dire over the past few years, we have long taken the middle-of-the-road approach that it would likely decline but remain a part of many networks for quite some time. That seems to be bearing out in the data. However, we did talk to some folks this year that have kept MPLS for now but may drop it later.

Network Security is Still Developing

ZTNA/SASE are still very much in the early stages of adoption, though awareness has increased over the past couple of years.

While zero trust and SASE are more frameworks than specific solutions, we found that the need to adopt such frameworks had certainly spread in the WAN manager world.

Stage of Zero Trust/SASE Adoption (Change, 2019-2021)

.png?width=723&name=Stage%20of%20Zero%20TrustSASE%20Adoption%20(Change%2c%202019-2021).png)

Some enterprises who have implemented elements of zero trust or SASE have really just done so through tools they have access to through cloud/XaaS providers, as opposed to having specifically rolled out solutions from the framework. Most of the enterprises we talked to were not ready to engage in a full network segmentation project.

The Emergence of 5G for the Enterprise

TeleGeography currently covers wireless in two separate areas: 1) consumer telecommunications data from our GlobalComms Database Service, and 2) as a broadband offering in our Business Broadband Research Service.

In each of those areas, we saw significant changes in 2021 for the availability of 5G services.

We also saw significant expansion of both the 5G consumer plans available and in the number of subscribers around the world.

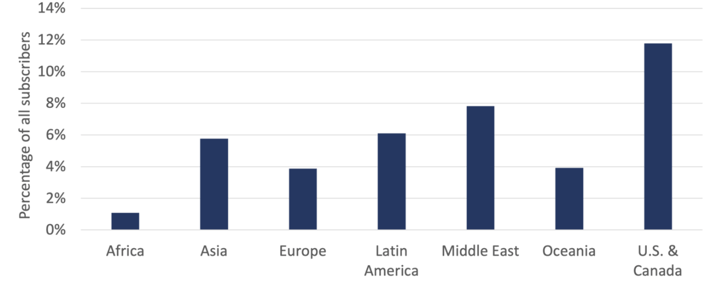

Regional 5G Subscriber Percentage

The availability of business broadband plans has expanded more into wireless services and the share of those wireless services that are 5G plans, while still very small, has grown over the past couple of years.

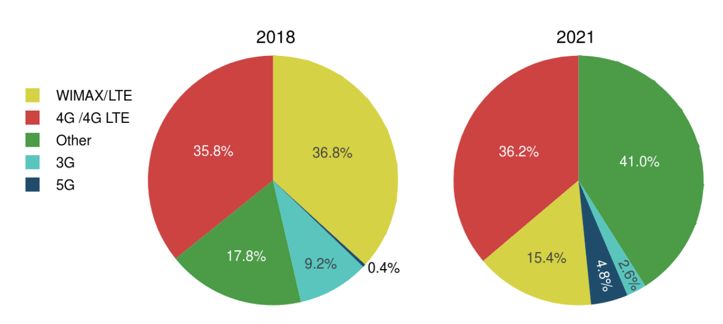

Global Overview of Wireless Plans

Greg Bryan

Greg is Senior Manager, Enterprise Research at TeleGeography. He's spent the last decade and a half at TeleGeography developing many of our pricing products and reports about enterprise networks. He is a frequent speaker at conferences about corporate wide area networks and enterprise telecom services. He also hosts our podcast, TeleGeography Explains the Internet.

Elizabeth Thorne

Elizabeth Thorne was formerly a Senior Research Analyst at TeleGeography. Her work was focused on enterprise network research.