What does the future hold for the global bandwidth market? The two most predictable trends are persistent demand growth and price erosion.

Beyond that, operators will have to navigate major uncertainties in continuing to move forward in an evolving sector. Here are a few of the key trends, among many, that will affect the long-haul capacity market in the coming years.

Expanding Frontiers by a Limited Group

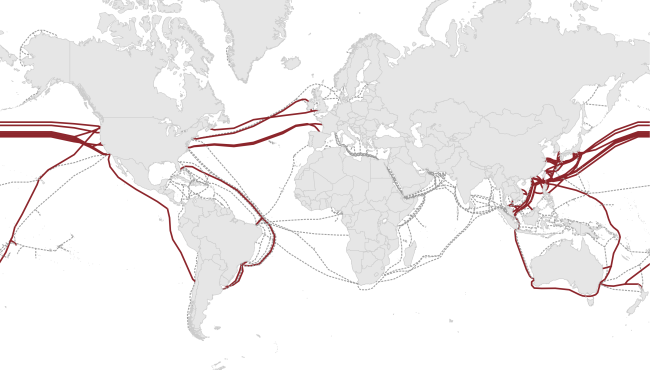

Content providers’ cable investments have largely focused on trans-Atlantic, trans-Pacific, U.S.-Latin American, and intra-Asian routes thus far. As their demand for capacity continues to grow across all routes, other paths are likely to draw content provider-backed cable construction in the near future. In particular, India-Singapore, India-Europe, and Europe-Africa may attract content provider interest in new systems.

Content Provider Demand Dominates Certain Routes

Map of Content Provider Submarine Cable Investments

Content provider demand dominates the development of certain routes; will new content providers follow suit? Our assessment is that a very limited group of players will continue to dominate international bandwidth demand. It seems unlikely that many more such networks will reach sufficient demand volumes in the near-term to warrant their emergence as full-fledged owners of subsea cables.

Rising Utilization

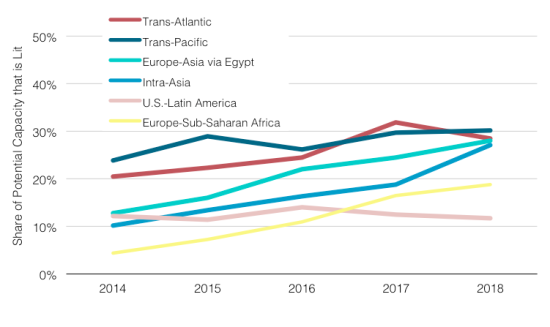

Even with the introduction of many new cables and the ability of older cables to accommodate more capacity, the growth of potential capacity has failed to outpace that of lit capacity.

Lit Capacity on Major Routes is Rising

Percentage of Potential Capacity that is Lit on Major Submarine Cable Routes, 2014-2018

This means that the percentage of capacity that is lit on major routes has started to rise. The one exception is the U.S.-Latin America route, where the recent launches of the three high-capacity cables has caused lit capacity to decline as a share of total potential capacity.

Looming Cable Retirements

Cables are engineered to have a minimum design life of 25 years—more on that here—but what really matters is the economic life. The economic life depends on a cable's revenue exceeding the costs. If the costs of operating a cable continually exceed the revenues, an operator may consider retiring the cable.

This could happen well before a cable runs of out capacity. Many older cables laid in the late 1990s and early 2000s may soon become candidates for retirement.

Addressing the Shannon Limit

In moving beyond 100 Gbps wavelengths, the industry faces a major challenge in that it will reach the very edge of the Shannon Limit—the theoretical channel capacity limit given a specified channel bandwidth and signal-to-noise ratio (SNR).

So how is the industry tackling this problem? By taking a multi-pronged approach. One technique to add more capacity on transoceanic systems in the short term will be to implement Spatial Division Multiplexing (SDM), which lowers the total output power per fiber pair and uses less power-intensive modulation to enable the addition of extra fiber pairs. Current transoceanic systems generally deploy 6 to 8 fiber pairs, but Dunant, which is slated to launch in 2020, will have 12.

Wholesale Market Challenges

The rapid expansion of major content providers’ networks has caused a shift in the global wholesale market. Google, Microsoft, Facebook, and Amazon are investing in new submarine cable systems and purchasing fiber pairs.

Although this removes large swaths of bandwidth from the managed wholesale bandwidth market, it also drives scale to establish new submarine cable systems and lower overall unit costs.

Although this removes large swaths of bandwidth from the managed wholesale bandwidth market, it also drives scale to establish new submarine cable systems and lower overall unit costs.

Many submarine cable business models actually rely on this capital injection, allocating fiber and network shares to the largest consumers to cover initial investment costs, then selling remaining shares of system capacity as managed wholesale bandwidth.

Unit cost savings of large investments are a great incentive to investment for operators, but they don't want to be left with too much excess bandwidth. It's often a race to offload wholesale capacity before a new generation of lower-cost supply emerges. Carriers most likely to succeed are those with massive internal demand and less dependence on wholesale market revenues.

Carriers most likely to succeed are those with massive internal demand and less dependence on wholesale market revenues.

Both content and telco network operators are reckoning with massive bandwidth demand growth, driven by new applications and greater penetration into emerging markets. The sheer growth in supply will drive lower unit costs for bandwidth. In the face of unrelenting price erosion, the challenge for wholesale operators is to carve out profitable niches where demand trumps competition.

Jon Hjembo

Senior Research Manager Jonathan Hjembo joined TeleGeography in 2009 and heads the company’s data center research, tracking capacity development and pricing trends in key global markets. He also specializes in research on international transport and internet infrastructure development, with a particular focus on Eastern Europe, and he maintains the dataset for TeleGeography’s website, internetexchangemap.com.