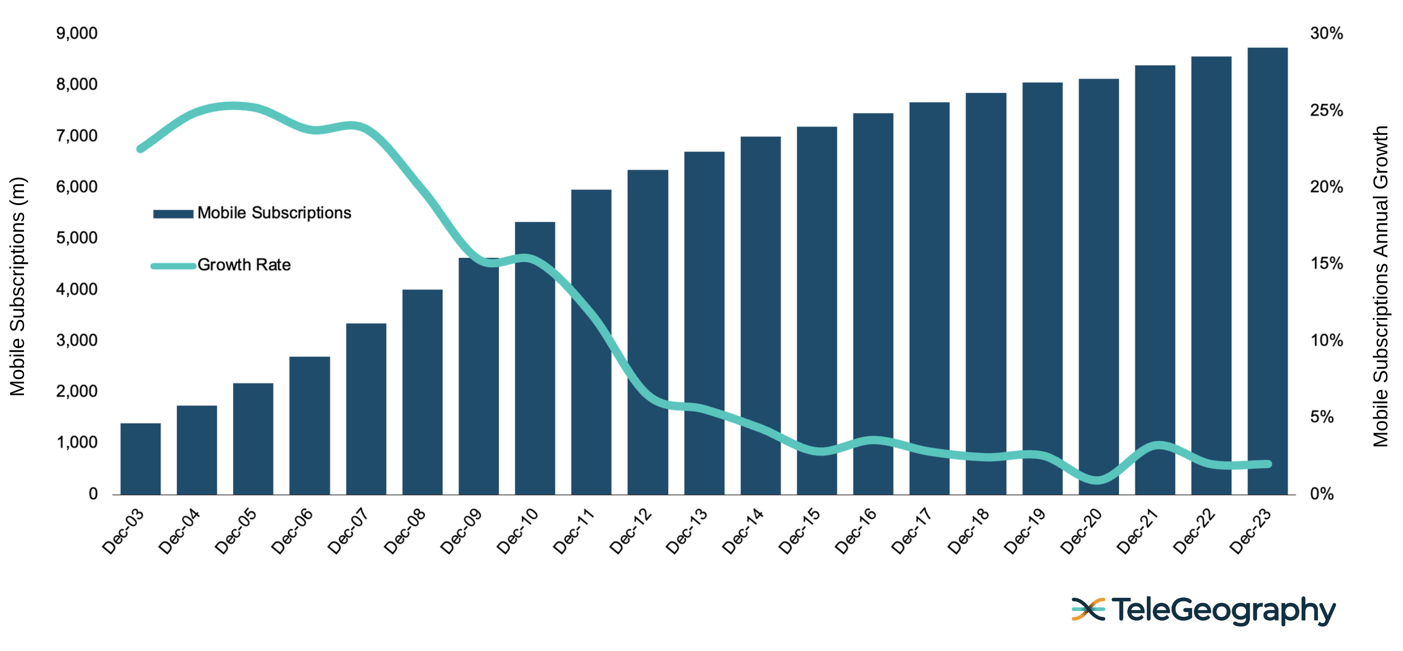

According to TeleGeography’s GlobalComms Database, the global mobile subscription total stood at 8.74 billion at the end of 2023, up 2.0% from 8.57 billion a year earlier.

Population penetration rose from 108% to 109% over the same period, boosted by the popularity of multiple SIM ownership in many markets.

Asia: Largest Mobile Market

In regional terms, Asia’s mobile sector is by far the largest worldwide. Together, China and India account for more than a third of global subscriptions.

China had 1.76 billion subscriptions at end-2023, up from 1.70 billion twelve months before. India’s mobile market climbed from 1.14 billion subscriptions to 1.16 billion over the same period.

Other big Asian mobile markets include Indonesia with 354.3 million subscriptions at end-2023, Japan (247.6 million), Pakistan (189.4 million), Bangladesh (187.5 million), Philippines (124.6 million), and Vietnam (124.1 million).

Mobile Sector Still Growing

Mobile Subscription Growth 2003-2023

Two of the fastest-growing Asian markets in 2023 were Macau and Myanmar.

Macau's mobile subscription total was up 13.2% in 2023 to 1.37 million, boosted by the popularity of roaming SIM deals for travelers from mainland China and Hong Kong.

Myanmar’s mobile sector is subject to a deal of state control—two of its four network operators have state backing. Nevertheless, the market grew by 9.8% in 2023 to reach 63.8 million subscriptions.

Africa Still Has Room for Growth

While population penetration in Africa is still some way behind other regions, the continent is seeing some of the strongest growth in subscription terms.

Africa claimed 18 of the top 40 fastest-growing mobile markets worldwide in 2023.

Africa claimed 18 of the top 40 fastest-growing mobile markets worldwide in 2023. The regional subscription total climbed 5.1% in 2023, reaching 1.36 billion.

Among the region’s rapidly expanding markets were Tanzania with subscriptions up 16.7% at 70.2 million, Rwanda (up 16.0% at 12.8 million), and Benin (up 14.7% at 16.7 million).

As we discussed in a recent blog post, Nigeria claims Africa’s largest mobile market with 217.5 million subscriptions at the end of 2023, up from 209.5 million a year earlier.

South Africa has one of the highest mobile penetration rates in Africa, boasting an estimated 118.9 million subscriptions at the end of 2023. The market is served by five main network operators: Vodacom, MTN, Telkom, Cell C, and Rain. A sixth firm, Liquid Intelligent Technologies, offers wholesale 5G connectivity in partnership with Vodacom. The country’s three biggest players—Vodacom, MTN, and Telkom—account for more than 90% of subscriptions between them.

Rest of the World

The U.S. and Canada saw very little mobile market growth in 2023. In fact, their combined subscription total went up only 0.5%. At the end of 2023, there were 410.3 million mobile subscriptions in the U.S. and another 39.9 million across the border in Canada.

The U.S. mobile sector is dominated by three main players. Verizon Wireless takes the number-one spot with 144.8 million subscriptions and 35% of the overall market, followed by T-Mobile (139.7 million customers and a 34% share), and AT&T (113.8 million subscriptions and 28% of the market).

In Europe, the regional subscription total climbed 1.4% in 2023 to just over one billion. The single largest market is Russia, with 238.8 million mobile users at end-2023. It is followed by five western European nations: Germany (117.1 million), the UK (89.3 million), France (78.5 million), Italy (77.1 million), and Spain (56.6 million).

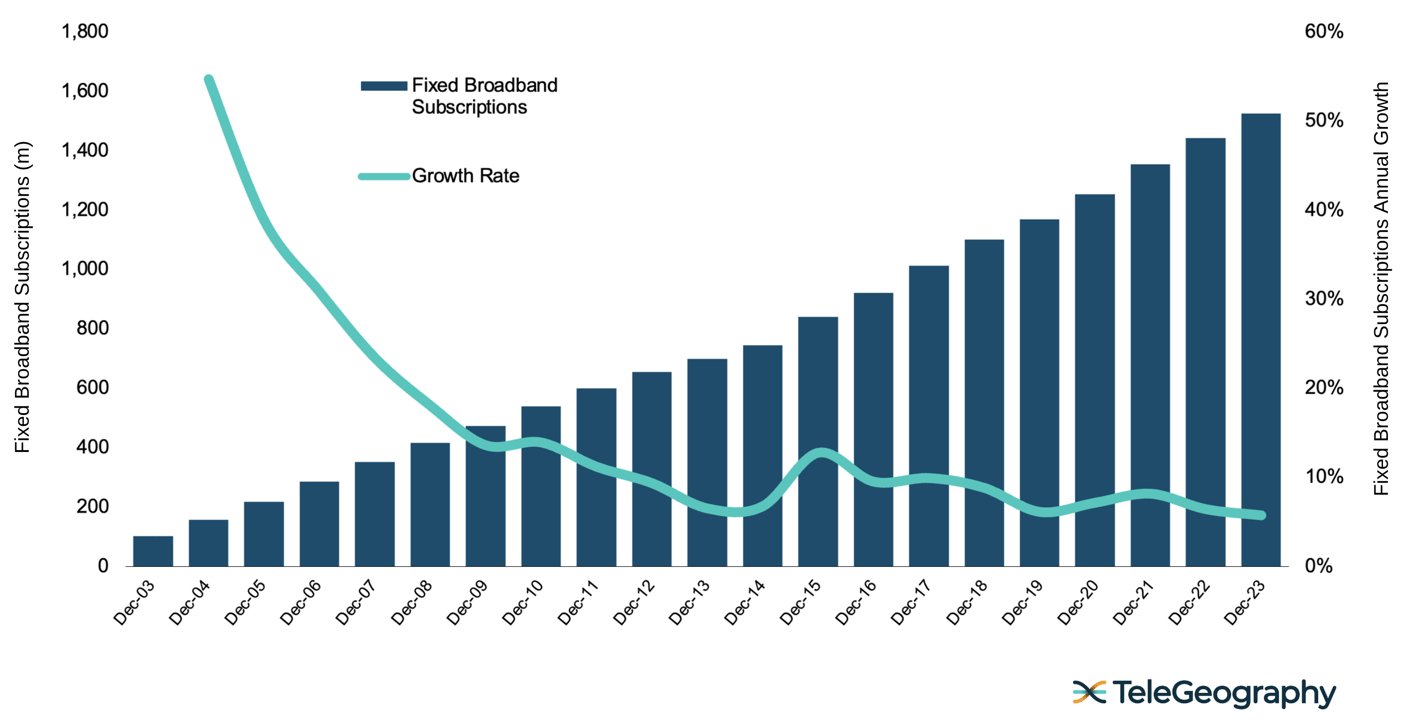

Fixed Broadband Doubles in Ten Years

Turning to the fixed broadband segment, there were 1.53 billion subscriptions at the end of 2023. This number increased 5.8% from 1.44 billion the year prior—and more than double the figure of 699 million a decade earlier.

Steady Growth

Fixed Broadband Subscription Growth 2003-2023

Once again, Asia claimed the largest slice of the overall market, with 898 million subscriptions at end-2023. Europe trailed behind with 263 million, followed by the U.S. and Canada with 149 million, and Latin America with 121 million.

Global household penetration reached 65% at the end of 2023, up from 62% twelve months before and 59% at end-2021.

While the U.S. and Canada could claim almost ubiquitous fixed broadband adoption as of December 2023, Africa languished well behind the other regions, with a penetration rate of just 12%. There is a continued appetite for broadband connectivity on the continent, though. The annual growth rate hit double figures for the past three years, sitting at 12.8% in 2023.

Globally, fiber-based networks were by far the most popular means of connectivity at end-2023, with 70% of all subscriptions via fiber.

Globally, fiber-based networks were by far the most popular means of connectivity at end-2023, with 70% of all subscriptions via fiber. Fiber replaced DSL as the main access technology back in 2016 and has been increasing its dominance ever since.

Pete Bell

Pete Bell is a Senior Analyst for TeleGeography’s GlobalComms Database and also contributes to the daily CommsUpdate newsletter. He has a particular interest in wireless broadband and was responsible for TeleGeography’s 4G Research Service until it was integrated into GlobalComms.