We recently surveyed a mixture of carriers and MSPs, SD-WAN vendors, and pure-play security vendors about their network security offerings in order to analyze what these services are and how they are being offered.

In this analysis, we also detail the available pricing models across services.

Here's an excerpt.

As we saw with the emergence of SD-WAN several years ago, we expected to see pricing models for SASE/ZTS services vary considerably by provider.

While we hope to one day add some actual prices to the survey, we first need to establish how providers are presenting charges for these services to enterprise customers and evaluate if the market is settling on specific pricing models we could use to compare across providers.

We asked respondents to identify how they charge customers for each service, whether by user, bandwidth, encrypted throughput, or by some other metric. Responses varied by provider, product, and security partner used.

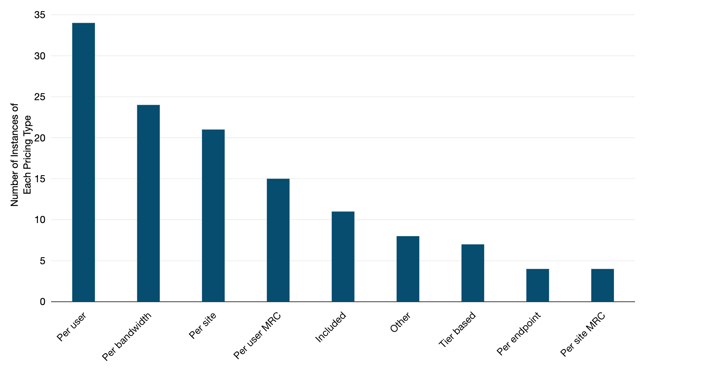

To better track pricing strategy trends, we distilled any long-form answers into discrete categories. We then tracked the number of instances a certain pricing strategy was noted across all providers and products.

Pricing Types Across All Products (2023)

Notes: Each bar represents the total number of instances of respondents noting each pricing type across all products. Source: TeleGeography © 2023 TeleGeography

Notes: Each bar represents the total number of instances of respondents noting each pricing type across all products. Source: TeleGeography © 2023 TeleGeography- The most common pricing strategy was to charge customers per user with 34 individual instances.

- Per site and per bandwidth were the next most common pricing strategies.

- Nearly a dozen times, providers indicated they did not have an additional charge to add a service to an existing security stack.

- There was a long tail of various pricing strategies listed that mostly used a mixture of strategies or some sort of monthly recurring cost per product.

- It is quite likely that in updates of this study that include a predetermined list of pricing strategies, we will be able to consolidate these categories that we constructed from long form answers. For example, “MRC” is likely not mutually exclusive with other categories, such as “per user” and “per bandwidth.” Future updates will provide respondents with specific categories to chose from, hopefully eliminating several categories.

This analysis was pulled from the new SASE module of our Cloud and WAN Research Service.

Learn more about this unique research suite over here.

Greg Bryan

Greg is Senior Manager, Enterprise Research at TeleGeography. He's spent the last decade and a half at TeleGeography developing many of our pricing products and reports about enterprise networks. He is a frequent speaker at conferences about corporate wide area networks and enterprise telecom services. He also hosts our podcast, TeleGeography Explains the Internet.