Europe might be a mature bandwidth market, but it still enjoys plenty of network investments and upgrades. And this continued infusion of bandwidth has left its mark on wholesale pricing.

Here's where things stand: recent and anticipated launches of new regional submarine cables continue to provide European markets with a fresh supply of bandwidth. And carriers’ upgrades of existing networks—as well as content providers’ expansions of their networks across Europe—impact transport pricing, all while meeting the demand for more bandwidth.

Over the past several years, the shift toward 100 Gbps technology has increased rapidly. And we’ve seen greater rates of price erosion for 100 Gbps wavelengths than for 10G in the region.

For instance, between 2017 and 2020, the weighted median for 100 Gbps on intra-European routes has decreased an average of 17% compounded annually and just 8% for 10 Gbps wavelengths.

Since the demand for 100 Gbps is becoming the new norm and only continues to grow, we expect transport prices to keep dropping.

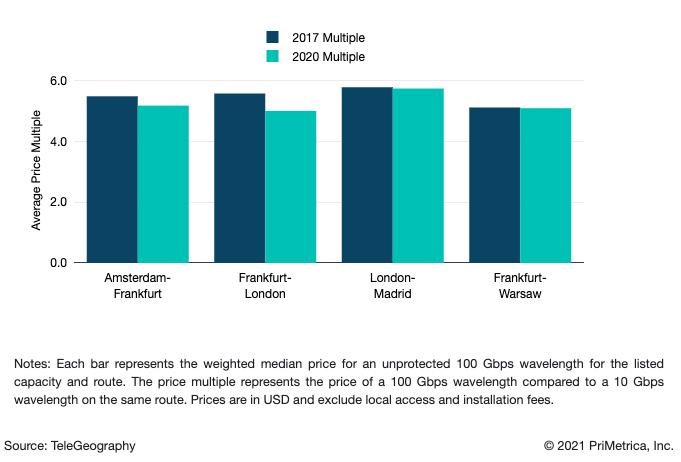

Because 100 Gbps wavelength prices have been eroding at a greater rate than those for 10 Gbps, price multiples continue to contract. In Q4 2020, the average price multiple across all surveyed European routes was 4.7 with the reported low of about 1.7. It’s important to note that such low price multiples may indicate the bargain-basement pricing nature of a particular carrier, and/or that the transaction was a sale of multiple 100 Gbps, which typically would include discounts.

Multiples Contract

10 and 100 Gbps Avg Carrier Price Multiples

Across the above routes, the average price multiple fell from 5.5 (as seen in 2017) to 5.3 (in 2020), indicating that 100 Gbps prices are falling at a slightly greater rate than those for 10 Gbps. This allows larger capacity to become a more cost-effective option for customers on a per unit basis than 10 Gbps.

The price multiples on the Frankfurt-London route had narrowed more than on any other route highlighted here. This shouldn’t come as a surprise, as this route offers some of the most competitive prices for both 10 Gbps and 100 Gbps.

If you're a buyer, it may be more cost-effective for you to invest in 100 Gbps rather than to incrementally upgrade your capacity, especially if you have large point-to-point capacity requirements.

If you're a buyer, it may be more cost-effective for you to invest in 100 Gbps rather than to incrementally upgrade your capacity, especially if you have large point-to-point capacity requirements.

Beyond enabling lower unit costs, 100 Gbps service also reduces the number of cross-connects and network management costs. Typically, carriers benefit from such streamlined operational and management costs, which then allows them to pass along some of the savings to their customers.

Between the growing adoption of 100 Gbps and demand for more bandwidth, carriers have started to prepare for—or have recently begun to launch—400 Gbps, 500 Gbps, 600 Gbps, and some even launched 800 Gbps capacity on their networks. (These higher bit rate wavelengths are how the capacity is carried but not the same as what is available for sale just yet.)

As customers begin to shift toward 400 Gbps and greater capacities, this will further drive the per-unit cost of 100 Gbps transport down.

The next step beyond 100 Gbps wavelengths will be 400 Gbps. Some carriers like Colt and Telia have announced plans to offer 400 Gbps in the near future. As customers begin to shift toward 400 Gbps and greater capacities, this will further drive the per-unit cost of 100 Gbps transport down.

Many customers use multiple 100 Gbps on some routes already so the move to a single 400 Gbps makes sense. Integrating 400 Gbps into networks will reduce complexity, lower cross-connect costs, and should, eventually, offer superior unit prices over 4 x 100 Gbps.

Like this kind of analysis? For even more on Europe's wholesale pricing, check out our Global Bandwidth Research Service.

Nataliya Coll

Nataliya Coll is a Senior Research Analyst at TeleGeography. As part of the pricing team, she contributes wholesale and enterprise product analysis. Nataliya focuses on European and Eurasia markets.