Unlike network services, SD-WAN is not a commodity, and pricing strategies are still in flux. But as the service matures, this is beginning to change.

Median price points have started to decline and the range in reported vendor prices has started to converge.

Let's unpack SD-WAN prices—starting with pricing models.

Please note that we've excluded service providers that offer managed SD-WAN service via partnership with another vendor from this data set.

Although this analysis is limited to SD-WAN suppliers that provide a service via their own proprietary technology, our SD-WAN Research Service does allow users to benchmark SD-WAN overlay pricing from both unmanaged and managed SD-WAN service suppliers.

Pricing Models

SD-WAN commercial transaction terms are still evolving, but most providers have settled on a mix of two pricing models:

- An upfront purchase plan for SD-WAN hardware that reduces subscription fees

- A subscription-based plan that spreads out the cost of the technology over the course of a multi-year contract

Most providers report they are happy to offer both, depending upon customer preference.

For our SD-WAN pricing research, we asked participants to assume a capex-based pricing model and provide their non-recurring charge (NRC) and monthly recurring charge (MRC) prices.

NRC prices included:

- The upfront cost of an SD-WAN appliance or software platform downloaded at individual customer site by bandwidth tier

- Any centralized controller costs and how many sites each controller can support

MRC prices included:

- Software license fees

- The charge for total encrypted bandwidth throughput at each network site

- Advanced monitoring features and firewall

- WAN optimization and premium security features broken out as separate charges

Non-Recurring Charges

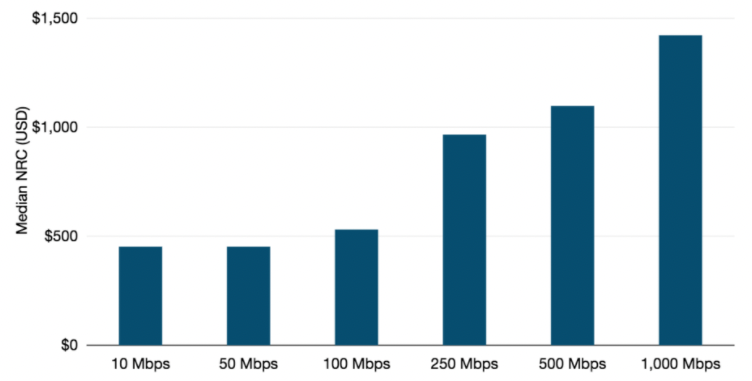

For most SD-WAN services, the most significant expense is the initial cost of hardware or software at each network site.

Some suppliers report a flat fee for SD-WAN appliances regardless of bandwidth, but most increase price with site bandwidth. The figure below illustrates this.

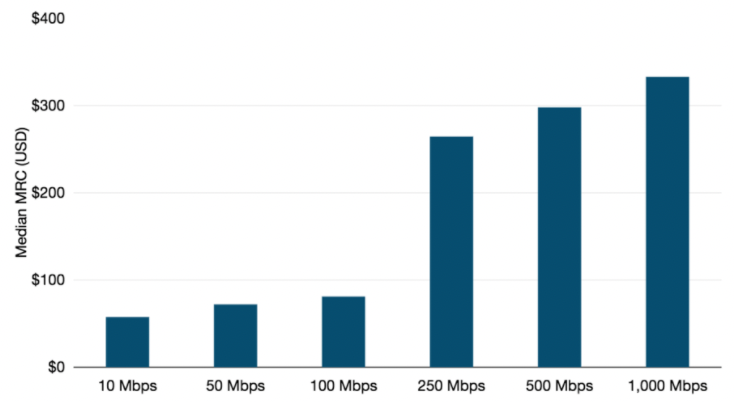

In 2021, the median price for a 10 Mbps SD-WAN site appliance was $452. At GigE, customers can expect to pay a median NRC price of $1,422. And for the largest sites on your network, such as headquarters or data centers, the NRC for a 10 Gbps appliance can run customers a hefty $8,823.

Across all capacities, median NRC prices decreased an average of 15% compounded annually since 2018. The largest price reductions were seen at lower capacities that represent the bulk of reported WAN sites. Median NRC prices for 50 Mbps and 100 Mbps sites have declined 17% and 15% compounded annually since 2018.

Median Non-Recurring SD-WAN Charges by Site Capacity, 2021

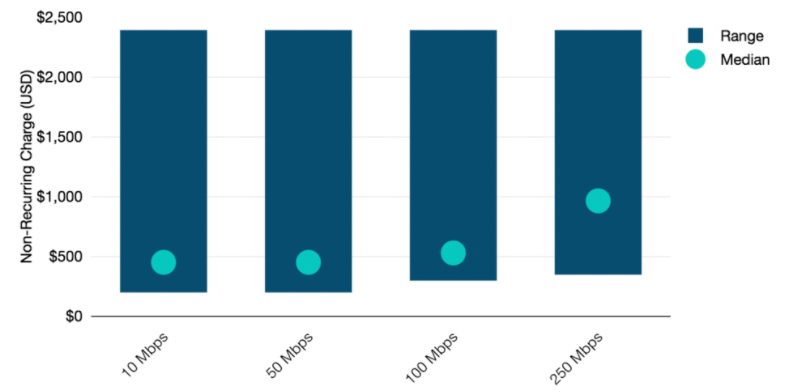

In addition to price erosion, we have started to see some convergence in the market between individual vendor price points.

In the figure below, the dark blue columns detail the range in reported SD-WAN NRC prices in 2021. The turquoise circles represent the median price.

It is important to note that we have limited this chart to those capacities where our WAN Manager Survey respondents indicated most of their WAN sites lie for MPLS, DIA, and broadband services.

Median & Price Range for Non-Recurring SD-WAN Charges by Site Capacity, 2021

Notes: Columns represent the reported price range for non-recurring charges for an SD-WAN appliance or software platform downloaded onto existing customer hardware for the listed capacity. Circles represent the median price. Prices are in USD. Source: TeleGeography, © 2022 TeleGeography

A few key trends stand out.

For lower capacity sites (10-100 Mbps), the median NRC price falls much closer to the lower end of the range, suggesting that a majority of SD-WAN vendor pricing is on this end of the spectrum. With a majority of reported WAN sites at these capacities, pricing appliances competitively for these bandwidths would help position suppliers well when calculating the total cost for the network overlay.

As site capacity increases, ranges expand substantially—a reflection of the varied approaches vendors have taken to pricing the service at larger network sites. At GigE, the high NRC price was 46 times the low. At 10 Gbps, the quoted high NRC price was a staggering 54 times the low. For those customers with many higher capacity sites in their network, it is important to assess a supplier's approach to the cost of SD-WAN appliances at these sites.

While reported ranges are substantial, they have compressed somewhat. The difference between the high and low 100 Mbps NRC price was down to eight, from over ten just a year ago.

Recurring Charges

Software licensing and total encrypted bandwidth throughput fees comprise the bulk of recurring SD-WAN charges. But they make up a much smaller portion of the total cost of an SD-WAN overlay than NRCs do.

As you can see in the figure below, like hardware pricing, MRCs increase as site capacity increases.

In 2021, the median MRC price for an SD-WAN implementation at a 10 Mbps network site was $58. At 100 Mbps and 1 Gbps sites, median MRC prices were $81 and $333, extending up to $1,097 per month for 10 Gbps.

Across all capacities, median MRC prices decreased a modest 3% compounded annually over the past three years. The biggest changes were seen at the 100 Mbps and 1,000 Mbps levels, where prices fell 11% and 17% compounded annually.

Median Monthly Recurring SD-WAN Charges by Site Capacity, 2021

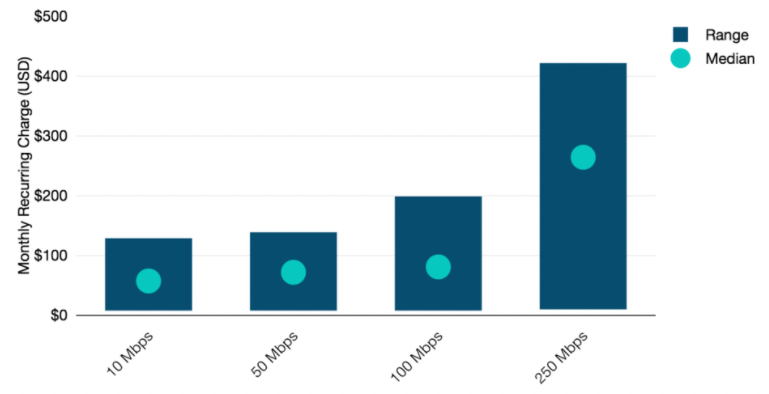

As we saw with NRCs, as SD-WAN has matured, MRC pricing between vendors has started to converge.

Median prices fall on the lower end of the reported range for lower capacities where a bulk of reported WAN sites lie and competition is higher. These capacities are where we also saw the biggest reduction in the range of reported pricing in 2021.

The range in pricing expands with capacity and the median shifts toward the middle, again pointing to the importance of assessing vendor pricing strategies depending on the mix of network site sizes across your WAN.

Median & Price Range for Recurring SD-WAN Charges by Site Capacity, 2021

SD-WAN pricing has clearly become more competitive as the service matures and pricing schemes evolve.

While median prices have not declined at quite the same pace as other WAN services, we've seen a number of individual vendor shifts lead to the shrinking price range discussed above and moderately eroding medians.

Brianna Boudreau

Senior Research Manager Brianna Boudreau joined TeleGeography in 2008. She specializes in pricing and market analysis for wholesale and enterprise network services with a regional focus on Asia and Oceania. While at TeleGeography, Brianna has helped develop and launch several new lines of research, including our Cloud and WAN Research Service.