This week it was announced that Equinix will buy several Verizon data centers for $3.6 billion.

According to a press release from Equinix, the deal in question includes 24 sites (29 individual buildings) across 15 markets. The Wall Street Journal has already reported that this would raise Equinix’s data center count to 175 around the globe.

So is Verizon shedding assets? Are they refocusing operations? What is Equinix’s plan?

Senior Analyst Jonathan Hjembo took time to speak with us about this deal and break down what it means.

JM: This week we all saw that Equinix acquired a portfolio of 24 data center sites from Verizon. First things first: what do you think this move is about?

JH: This is a continuation of an aggressive expansion plan Equinix has undertaken over the past year or so.

We had the Bit Isle and Telecity acquisitions at the beginning of the year and now the purchase of these Verizon assets. Equinix is taking a multi-pronged approach – bolstering key markets where it already has presence, working to capture new customers and verticals at desirable facilities, and to some degree moving into new markets.

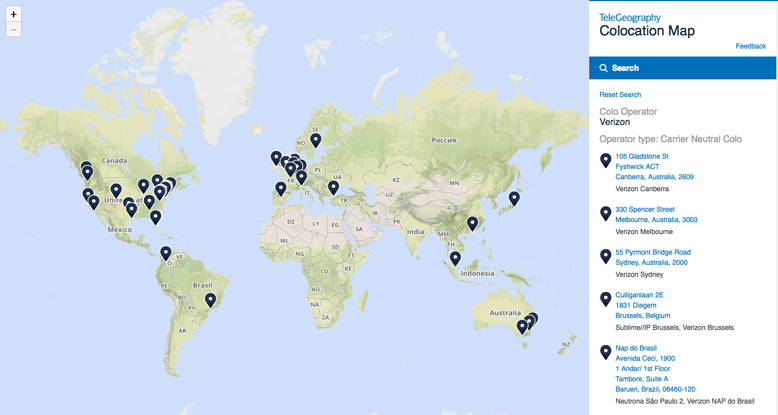

Verizon's current spread of colocation sites around the world.

JM: How does this purchase alter their footprint?

JH: What’s interesting is that this very selective asset purchase primarily shores up their presence in key existing markets. They didn’t move into a lot of new markets with this one – just Houston and Bogotá. Some might say Culpepper is a new market as well, but it’s really within the orb of the Northern Virginia (NoVA) market.

So, in choosing their Verizon assets, they expanded almost exclusively in existing markets, most notably with massive footprint increases in Dallas, Miami, NoVA, Atlanta, Boston, Denver, Seattle, and São Paulo.

This is not entirely unlike the pattern seen in the earlier acquisitions this year, although they gained several new markets with the Telecity buy. Nonetheless, core markets were a big part of the Telecity acquisition too. They grew 90 percent in Amsterdam and 49 percent in Paris, even after being forced to divest some assets in the key European markets. And with Bit Isle, they expanded data center space in Tokyo by 186 percent.

In choosing their Verizon assets, they expanded almost exclusively in existing markets, most notably with massive footprint increases in Dallas, Miami, NoVA, Atlanta, Boston, Denver, Seattle, and São Paulo.

JM: What does this acquisition tell us about Equinix’s plans?

JH: I think that while they’re interested in expansion into new markets, they’re also fully committed to trying to dominate the biggest mature global markets.

In pursuing that goal, they want new customers and customer segments that can be quickly attained through acquisitions. If we look at their recent announcement about being the landing party for the Monet subsea cable, it’s also very clear that they want to capture the interconnection market. They see content providers increasingly driving long-haul network demand and routing patterns, and they want to be positioned where content is connecting to eyeballs. That was a big part of the Verizon purchase, in particular being able to nab the big prize of NAP of the Americas in Miami.

JM: Let’s pivot to Verizon. Remind us why they’d be selling their colocation assets.

JH: This also seems to be a continuation of a developing pattern.

Several years ago, Verizon, CenturyLink, Zayo, and a few other carriers jumped headlong into the colocation vertical, mostly through acquisitions. But this year, we’re starting to see a reversal. Windstream started things off by selling its data centers to TierPoint. Then CenturyLink just announced that it was selling its data centers and colocation business – though it seems that they are not actually exiting the market. AT&T has been rumored to consider selling its data centers. And now Verizon.

Several years ago, Verizon, CenturyLink, Zayo, and a few other carriers jumped headlong into the colocation vertical, mostly through acquisitions. But this year, we’re starting to see a reversal.

I think the biggest reason Verizon is selling is that it wants to shore up focus on its key competencies. Carriers haven’t had the easiest time integrating carrier-neutral data centers into their portfolios.

It’s also worth noting that, if Verizon’s purchase of Yahoo! goes through, this would give it some cash to cover the $4.83 billion price tag. That’s something to consider.

JM: This deal still leaves Verizon with a number of data centers, right?

JH: Yes, but maybe not for long. I wouldn’t be surprised if one or more buyers pick up the rest. Verizon still has European and Asian sites that could be up for grabs.

Jon Hjembo

Senior Research Manager Jonathan Hjembo joined TeleGeography in 2009 and heads the company’s data center research, tracking capacity development and pricing trends in key global markets. He also specializes in research on international transport and internet infrastructure development, with a particular focus on Eastern Europe, and he maintains the dataset for TeleGeography’s website, internetexchangemap.com.