Readers of our Pricing Suite's latest Bandwidth Pricing Report already know that the Middle East serves as both an important node and a crucial transitway for international capacity.

Cable operators were extremely busy between 2011 and 2017 when they turned up nine new cables in the region. But submarine cable activity slowed quite a bit between 2018 and 2020, as no new cables were launched in the region.

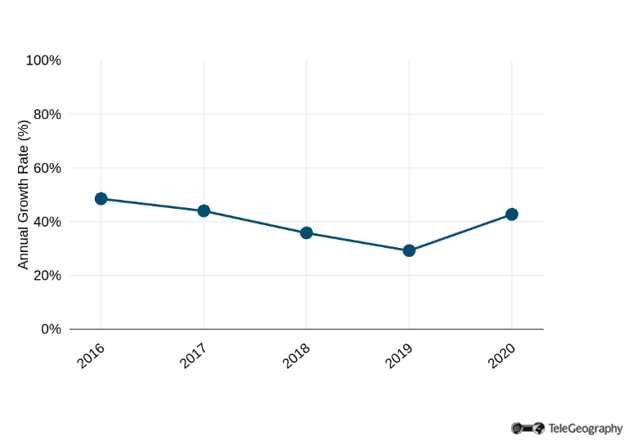

This doesn't mean Middle East international bandwidth trends were quiet in 2020. In fact, after years of slowing international bandwidth growth rates, there was a notable uptick from 2019 to 2020.

Growth Spurt

Middle East International Bandwidth Usage Annual Growth Rate

What's behind this surge?

What's behind this surge?

First, in March of 2020, internet traffic patterns shifted and volumes grew due to the global COVID-19 pandemic. Students around the world learned from home, adults worked from home, and everybody did at least something from home. This drove up access traffic and, ultimately, backbone traffic and capacity demand.

Another important change that fueled international bandwidth deployments: the arrival of content and cloud service providers.

In 2019, these content providers only accounted for 4% of the bandwidth connected to the region. But content providers have been adding bandwidth at a breakneck pace since then.

That said, the share of content and cloud service provider bandwidth connected to the Middle East still represents a far lower share in comparison with other regions, like Europe or Asia.

From a commercial perspective, long-haul price erosion rates have been more rapid across other global routes. Meanwhile, the price for a 10 Gbps wavelength from Fujairah cable landing station to a PoP in Marseille fell only 4% compounded annually over the past three years.

From a commercial perspective, long-haul price erosion rates have been more rapid across other global routes. Meanwhile, the price for a 10 Gbps wavelength from Fujairah cable landing station to a PoP in Marseille fell only 4% compounded annually over the past three years.

Why? The region’s end-user bandwidth demand is met largely by incumbents and second operators in the Middle East, many of whom own or have invested in numerous submarine cables. As a result, these operators simply deploy capacity on their sub-cable assets as needed.

While 10 Gbps prices have not changed much in recent years, a new market dynamic is at play in the region: high volume sales.

It's only recently that carriers started to report increased demand for 100 Gbps wavelengths. The arrival of cloud and content provider PoPs in the region coincided with skyrocketing end-user demands in light of the 2020 pandemic.

These events ushered in—and accelerated—demand for high capacity wavelengths. And as past global trends indicate, where there’s content and cloud presence, there’s higher bandwidth demand.

There's a lot more to this story.

Read the full Middle East bandwidth review in our latest Bandwidth Pricing Report, part of TeleGeography's unique Pricing Suite.

Log into your subscription at TeleGeography.com. Or ask our sales team about how to access the Pricing Suite.

Kate Reilly

Kate Reilly is a Senior Analyst at TeleGeography. As part of the pricing team, Kate contributes analysis to both enterprise and wholesale products.

Paul Brodsky

Paul Brodsky is a Senior Research Manager at TeleGeography. He is part of the network, internet, cloud, and voice research team. His regional expertise includes Europe, Africa, and the Middle East.