A planned auction of spectrum in the 694MHz-790MHz (700MHz) band in Sweden has been postponed, while the recent sale of frequencies in the same band in India attracted no bidders.

Although the 700MHz band is seen as crucial to promoting the future development of mobile broadband services, is it still too early for operators in some markets to commit to acquiring spectrum in this range?

Europe Takes Its First Steps

The EU is looking to make the 700MHz band available across the whole of Europe by mid-2020 to boost mobile broadband service coverage. Lower frequencies such as this are favorable for data services because they provide better indoor penetration than higher bands.

The fact that the 700MHz range will eventually be available worldwide means it will create a harmonized global band for the first time, while supporting a larger ecosystem to offer greater economies of scale.

Once digital terrestrial television broadcasts at 700MHz have been migrated to the 470MHz-694MHz range, the way will be open for cellcos to begin using this “second digital dividend.”

While this divide is still several years off, two major European markets have already moved ahead with 700MHz mobile broadband auctions. Germany sold off 700MHz licenses in May 2015, whilst France followed suit in November that year.

Many other markets are still at the consultation and planning stage, meaning telcos still have some time before they commit themselves to investing in costly new licenses.

The Swedish sale had been scheduled for 1 December but the government called it off to study whether some frequencies should be set aside for defense, public safety, and government use.

Meanwhile, Finland and Iceland unveiled tentative plans for 700MHz auctions earlier this year, though neither country has yet to announce a concrete sale schedule.

Many other markets are still at the consultation and planning stage, meaning telcos still have some time before they commit themselves to investing in costly new licenses. The UK, for example, had previously said it was unlikely to open up the 700MHz band until end-2021, although it has now brought this forward to match the EU’s mid-2020 timeframe.

Indian Sale Falters

High prices are believed to have deterred operators from bidding in India’s October 2016 auction of 700MHz spectrum. The government had put all available frequencies (2×35MHz) up for sale, with a reserve price of INR114.85 billion per MHz (paired).

Operators instead spent their money on 4G-capable spectrum in the 1800MHz, 2100MHz, and 2600MHz bands, fulfilling their immediate needs rather than securing frequencies for future expansion.

Operators instead spent their money on 4G-capable spectrum in the 1800MHz, 2100MHz, and 2600MHz bands, fulfilling their immediate needs rather than securing frequencies for future expansion.

Some Asian markets are already utilizing the 700MHz range, however, with operators in countries including the Philippines, Japan, and Taiwan currently using the spectrum for 4G services. Cellcos in Australia and New Zealand have also launched commercial LTE networks in the same band. There are also two 700MHz 4G networks in operation in Africa, run by Globacom of Nigeria and KTRN of Rwanda.

Success Stories

Elsewhere, operators in the Americas have been active in the 700MHz range for some time now, with the U.S. sector particularly active.

AT&T, Verizon, T-Mobile, and U.S. Cellular all have extensive LTE networks in operation, the first two firms having built out near nationwide footprints. There is also a busy secondary spectrum market, with cellcos – notably T-Mobile – trading frequencies to fill in coverage gaps.

South of the border, authorities in Mexico are soon to announce the winner of a tender to build a nationwide open access 700MHz 4G network, while systems are already live in markets such as Brazil, Peru, Panama, and Jamaica.

There are currently a total of around 60 live 700MHz systems in Asia, Africa, and the Americas, and with activity now beginning to ramp up in other regions, we can expect many new developments over the next few years as the band becomes the focus of operators’ mobile broadband rollouts across the globe.

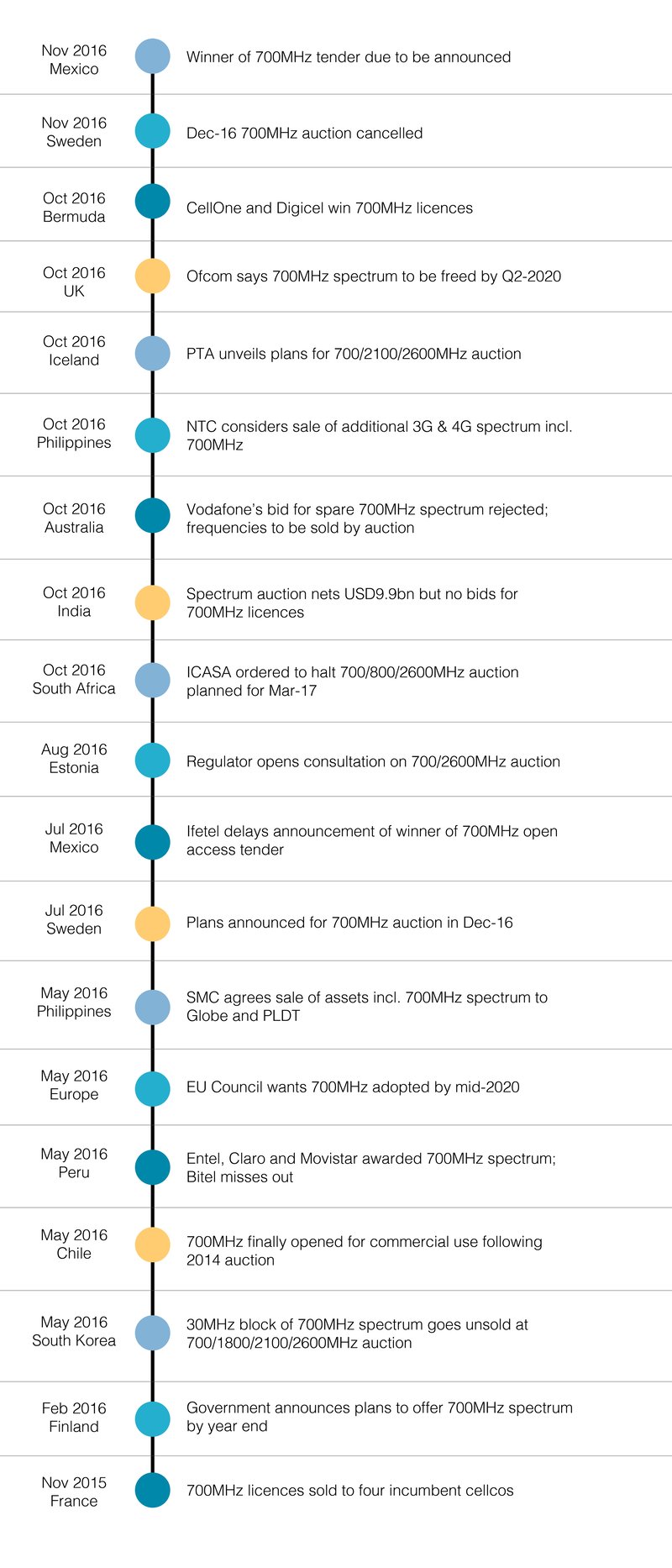

Major Developments in the 700MHz Band Over the Past 12 Months

Pete Bell

Pete Bell is a Senior Analyst for TeleGeography’s GlobalComms Database and also contributes to the daily CommsUpdate newsletter. He has a particular interest in wireless broadband and was responsible for TeleGeography’s 4G Research Service until it was integrated into GlobalComms.