We've said it before and we'll say it again. When it comes to the global bandwidth market, the two most predictable trends are persistent demand growth and price erosion.

But if the latest update of our Global Bandwidth Research Service teaches us anything, it's that there's more beneath the surface.

When we look to the future of the global bandwidth market we see that operators will have to navigate the major uncertainties of an evolving sector and a global pandemic.

Today we want to look at other key trends—among many—that will affect the long-haul capacity market in the coming years.

Up, Up, and Away: Utilization on the Rise

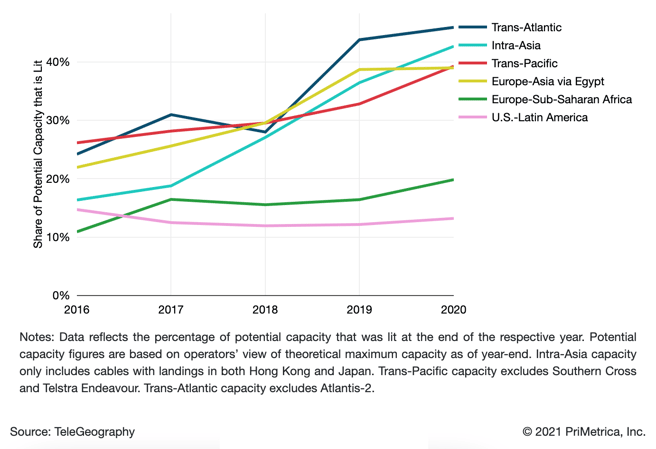

The most fundamental driver for new cable construction is the limited availability of potential capacity. This issue might not appear important on major cable routes, where the percentage of potential capacity that is lit has only recently exceeded 30%.

Even with the introduction of many new cables and the ability for older cables to accommodate more capacity, the growth of potential capacity has failed to outpace that of lit capacity.

Even with the introduction of many new cables—and the ability for older cables to accommodate more capacity—the growth of potential capacity has failed to outpace that of lit capacity. (Here's a quick explainer on that.)

This means that the share of capacity that is lit on major routes has begun to rise.

Percentage of Potential Capacity that is Lit on Major Submarine Cable Routes

Looking at the lit share of potential capacity is not the only way to measure utilization. In fact, the availability of fiber pairs is emerging as a key metric on routes where content providers are involved.

Thus, when gauging potential supply on a route it's important to bear in mind not just how much unlit capacity remains but whether unlit fiber pairs are available as well.

Uncertain Growth for Content Providers

Content providers' international capacity has grown rapidly in recent years, but how long can this last?

Most network planners in these companies focus on meeting expected growth for a two-to-three-year planning horizon. In our discussions with content providers, all of them have indicated challenges in forecasting their longer-term demand requirements.

A few aspects that influence growth rates include:

- New applications: Artificial intelligence and virtual reality are most frequently cited as future applications that will drive demand. The degree to which these will impact international demand remains unclear.

- Multiple product lines and users: Content providers' bandwidth demand comes from a large number of services within their companies. In the case of Google, there is search, YouTube, maps, cloud, and more. It's also worth noting that the bandwidth demand for Google Cloud, AWS, and Microsoft Azure isn't related to these companies' internal demand, but rather enterprises' implementation and usage of these cloud platforms.

- Timing of new cables: Recently, major content provider investments have reduced reliance on carriers and have focused on securing enough wholly-owned fiber pairs to achieve sufficient route diversity. Increasingly, new capacity is added largely through the introduction of new cable systems. Thus, annual capacity growth rates observed on some routes could appear lumpy as they are largely influenced by when new submarine cables enter service.

More Wholesale Market Challenges

I actually wrote about this exactly one year ago. And while there have been some developments worth highlighting, I think the sentiment bears repeating.

Here's the summary if you missed last year's post: the rapid expansion of major content providers’ networks has caused a shift in the global wholesale market. Google, Microsoft, Facebook, and Amazon are investing in new submarine cable systems and purchasing fiber pairs. This removes huge sources of demand from the addressable wholesale market. On the other hand, it drives scale to establish new submarine cable systems and lower overall unit costs.

Now, many submarine cable business models rely on this capital injection, allocating fiber and network shares to the largest consumers to cover initial investment costs, then selling remaining shares of system capacity as managed wholesale bandwidth.

Now, many submarine cable business models rely on this capital injection, allocating fiber and network shares to the largest consumers to cover initial investment costs, then selling remaining shares of system capacity as managed wholesale bandwidth.

Unit cost savings of large investments are a great incentive to invest for operators, but they don't want to be left with too much excess bandwidth. It's often a race to offload wholesale capacity before a new generation of lower-cost supply emerges. Carriers most likely to succeed are those with massive internal demand and less dependence on wholesale market revenues.

Both content and carrier network operators are reckoning with massive bandwidth demand growth, driven by new applications and greater penetration into emerging markets.

The sheer growth in supply will drive lower unit costs for bandwidth. In the face of unrelenting price erosion, the challenge for wholesale operators is to carve out profitable niches where demand trumps competition.

There's more like this in our freshly updated executive summary.

For full access to the datasets, search tools, downloadable resources, and extended analysis in the Global Bandwidth Research Service, email our team at info@telegeography.com.

Alan Mauldin

Alan Mauldin is a Research Director at TeleGeography. He manages the company’s infrastructure research group, focusing primarily on submarine cables, terrestrial networks, international Internet infrastructure, and bandwidth demand modeling. He also advises clients with due diligence analysis, feasibility studies, and business plan development for projects around the world. Alan speaks frequently about the global network industry at a wide range of conferences, including PTC, Submarine Networks World, and SubOptic.